[앵커]

They found that the delinquency rate of personal business loans increased steadily as the interest burden increased during the recession.

The government has decided to expand the target of the low interest loan exchange program, which is currently provided only to small businesses affected by Corona 19, to every single business and double the limit.

Reporter Kang Hee-kyung reports.

[기자]

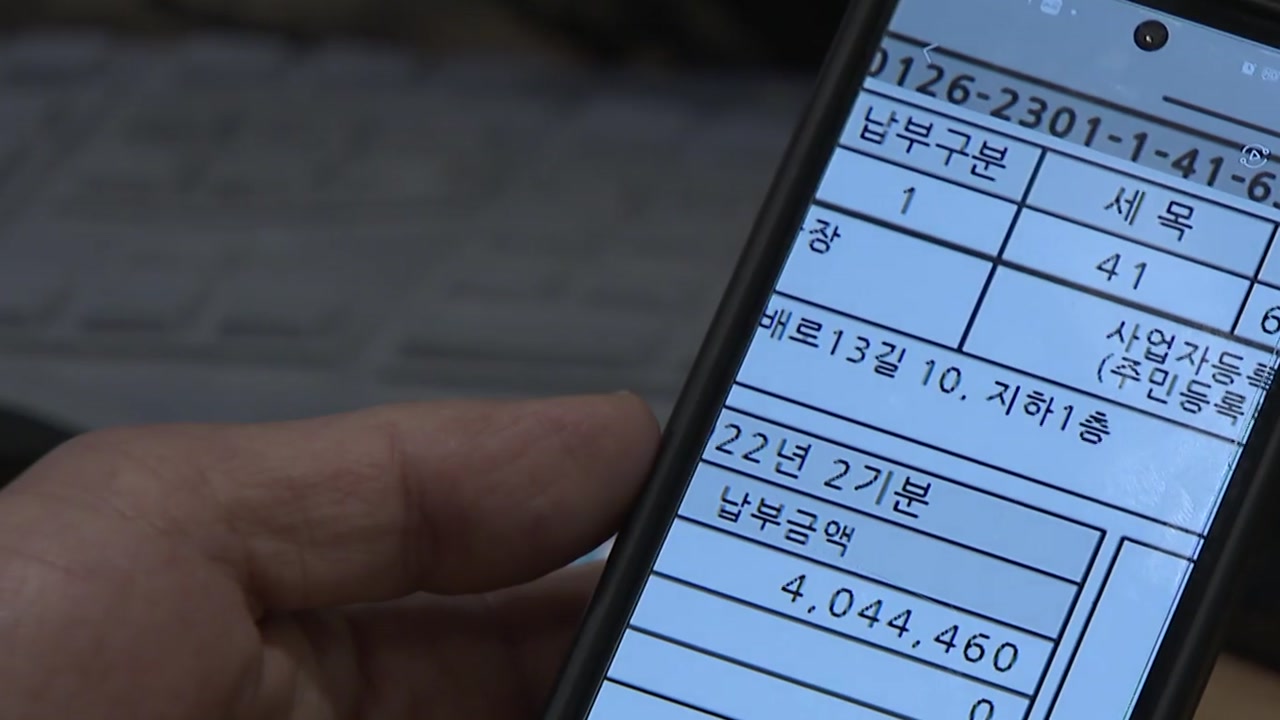

Lee Jae-in, who runs a coin karaoke in Sangdo-dong, Seoul, says the interest rate on loans is just as alarming as the drop in sales.

The loan interest, which was earned around 1 million per month in the early days of Corona 19, has recently doubled.

Although the situation has improved slightly with the removal of indoor masks, etc., it is still difficult to continue business due to the increase in public charges.

[이재인 / 코인노래방 운영 : 인건비나 전기요금 같은 부분도 어려운 상황에서 생존과 직결된 금리가 너무 가파르게 올라서 지금 매우 어려운 상황이고요.]

As the interest rate burden has increased, focusing on small business owners and the self-employed, warning lights have also come on about loan soundness.

As a representative example, the delinquency rate of commercial bank loans is creeping up bit by bit.

In particular, the average delinquency rate for individual business loans rose by 0.06 percentage points from 0.18% in September last year to 0.24% in December.

The number of people who cannot endure the prolonged high interest rates in the recession seems to be steadily increasing.

[차남수 / 소상공인연합회 정책홍보본부장 : 이자까지 안 냈을 때의 부담을 알고 있었던 거였습니다. 그런데 이제는 그거조차도 내기가 너무나도 버거운 상황에 도달했다….]

Financial authorities are speeding up the preparation of countermeasures

First of all, it was decided to expand the application of the low interest loan exchange program from small business owners and self-employed people affected by COVID-19 to all small business owners and self-employed people, and to double the support limit. .

It is a program that converts high interest loans of 7% or more per annum into low interest rates.

From the end of September last year until the end of January this year, 7,300 cases were converted and 270 billion won.

[김주현 / 금융위원장 (지난달 27일) : (지원 대상을) 코로나19 피해자에서 모든 자영업자로 확대하고 이용한도 상향 등 이용 편의를 높여 제도의 실효성을 높여 나가겠습니다.]

The Financial Services Commission also plans to allow small businesses affected by Corona 19 to switch home credit loans to low interest rates within a certain limit.

Although the interest rate is still at a high level, attention is focused on whether this measure can relieve the self-employed who are driven into a corner.

This is Kang Hee-kyung from YTN.

YTN Kang Hee-kyung (kanghk@ytn.co.kr)

※ ‘Your report becomes news’

[카카오톡] Search YTN and add a channel

[전화] 02-398-8585

[메일] social@ytn.co.kr

[저작권자(c) YTN 무단전재 및 재배포 금지]