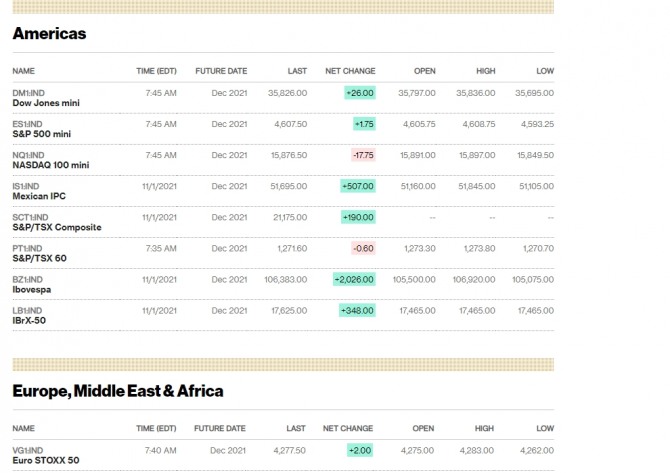

Futures prices are rising again in the New York Stock Exchange despite the tapering and fears of a rate hike. A rise in Nasdaq Dow futures could act as upward pressure on the regular New York Stock Exchange. Bitcoin is also rising again. The interest rate on government bonds, the international oil price, and the dollar exchange rate are fluctuating. .It is unusual for the New York stock market to rise day after day while tapering and interest rate hikes are being pursued amid concerns over inflation. The rally in the New York Stock Exchange is not holding back as companies listed on the New York Stock Exchange showed strong 3Q corporate earnings.

The New York Stock Exchange is facing a critical moment. An employment report will be released soon as the US Federal Reserve opens its FOMC to discuss tapering. As a result, the Nasdaq Dow is expected to fluctuate in the New York Stock Exchange. International oil prices, government bond yields and the dollar exchange rate are also closely watching the tapering and employment reports. Cryptocurrencies such as Bitcoin are on a downward trend.

According to the New York Stock Exchange on the 2nd, the Fed is expected to hold its FOMC meeting on the 3rd and announce a tapering of asset purchases. Fed members had expected the tapering to begin in November or December and finish by mid-next year. The official announcement will be made early in the morning of the 4th Korean time. Fed Chairman Jerome Powell is expected to emphasize that the tapering does not automatically raise interest rates after the tapering ends, so as not to cause market unrest. Indicators and speech schedules that may affect the New York stock market include: November 2 = Economic optimism index, automobile sales, and the start of the Federal Open Market Committee (FOMC) regular meeting Pfizer, BP, DuPont, ConocoPhillips, T-Mobile, Jill Low performance announcements, etc. On November 3rd, ADP employment report, Markit services PMI, ISM non-manufacturing PMI, factory reorders, FOMC base rate decision, Fed Chairman Jerome Powell press conference, Qualcomm, CVS Health, MGM Resorts, and Win Resort earnings will be announced. Bitcoin is exploding again on the New York Stock Exchange.

In the New York Stock Exchange, which closed on the morning of the 1st (Korean time), the three major indices again broke all-time highs. On the New York Stock Exchange (NYSE), the Dow Jones Industrial Average closed at 35,913.84, up 94.28 points (0.26%) from the previous day. The Standard & Poor’s 500 Index finished at 4,613.67, up 8.29 points (0.18%) from the battlefield, and the Nasdaq, centered on technology stocks, finished at 15,595.92, up 97.53 points (0.63%) from the battlefield. The three major New York stock indexes closed at all-time highs last week and hit all-time highs on the first trading day of November. The Dow crossed 36,000 for the first time ever. The strong performance of companies is leading to a stock price rally. According to the Chicago Mercantile Exchange (CME) FedWatch, the Federal Funds (FF) interest rate futures market reflected an 86% chance of a rate hike in September next year. We reflected the possibility of a rate hike in June next year at 65.7%. On the Chicago Board Options Exchange (CBOE), the Volatility Index (VIX) rose 0.15 points (0.92%) to 16.41.

Bitcoin is showing an upward trend. Following Bitcoin, Ethereum, Ada, and Ripple are also on the rise. Two major ‘Meme Coins’ with Shiba Inu as their mascots entered the top 10 of the cryptocurrency market capitalization rankings side by side. Shibainu and Dogecoin are ranked 9th and 10th by market capitalization of cryptocurrencies in turn.

Daeho Kim, Director, Global Economic Research Institute tiger8280@g-enews.com

[알림] This article is for investment judgment reference only, and we are not responsible for any investment loss based on it.

.