(Seoul = Yonhap Infomax) Reporter Yoon Eun-byeol = Korea’s Foreign Capital Management Bank said it is more important to maintain dollar liquidity than to buy gold in addition, which has maintained the same holdings for nearly 10 years.

On the 6th, the Bank of Korea’s Foreign Capital Management Institute said in the ‘Status of Bank of Korea’s Reserve Management and Future Gold Management Guidance’, “A careful approach is needed as to whether the expansion of gold holdings among foreign exchange reserves is essential.” In the this possible situation, it is better to maintain the liquidity of the US dollar than to expand gold holdings.”

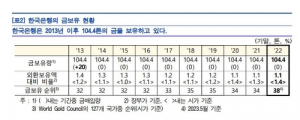

Previously, central banks in some countries greatly expanded their gold purchases due to concerns about the US banking sector crisis, a weak dollar, and moves to ‘de-dollarize’. The BOK has maintained the same gold holdings since 2013 without additional purchases.

The Foreign Capital Control Board also explained that since 2018, gold prices have largely been consistent with the investment performance of US government bonds, so there is little need for the BOK to sell US Treasury bonds and buy gold, the he’s holding it right now. dollar liquidity.

It was also mentioned that selling gold held by the BOK could send the wrong signal to the market.

The Institute of Foreign Capital Management explained, “Gold has relatively low liquidity and is perceived as the last resort among foreign exchange reserves, so there is a possibility of giving an unexpected signal to the market when selling.”

The recent surge in gold prices, threatening the previous peak, and uncertain future potential are also factors preventing the expansion of gold holdings. The price of gold, which remained between $1,100 and $1,300 until the mid-2010s, fluctuated around $1,800 after surpassing $2,000 in 2020, and showed an upward trend again this year.

The Institute of Foreign Capital Management said, “Depending on the global economy, a strong dollar can appear at any time, and the fact that the real interest rate, the opportunity cost of gold, has turned positive is also a constraint on the increase in gold. prices.”

Meanwhile, the BOK’s gold reserves stood at 104.4 tonnes from last year, accounting for 1.1% of its foreign exchange reserves. His world gold holdings were ranked 38th, down four places from the previous year.

ebyun@yna.co.kr

(end)

This article was submitted at 12:00, 2 hours earlier on the Infomax financial information terminal.

Send SNS articles