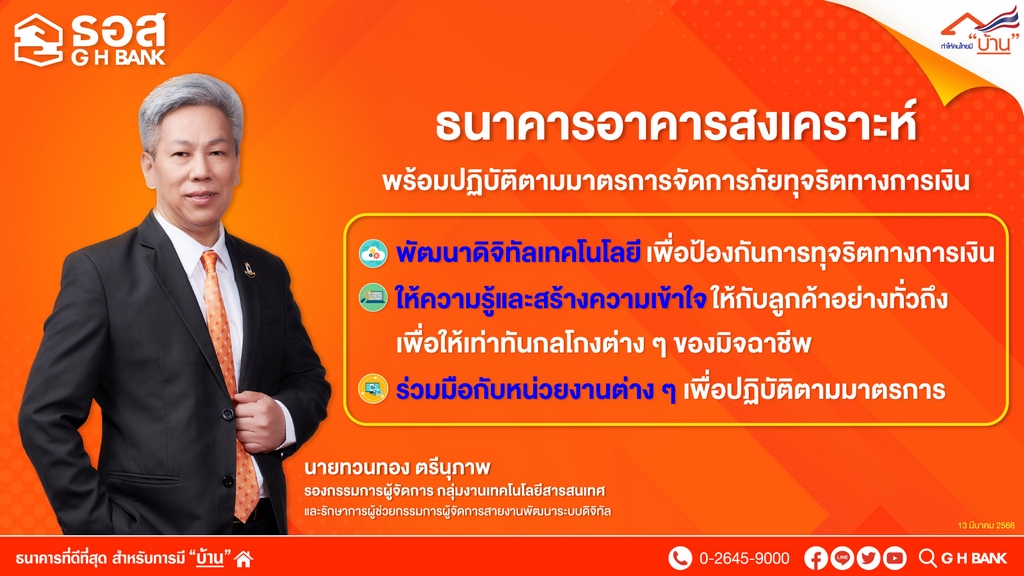

Mr. Thuanthong Trinuphap, Deputy Managing Director of Information Technology Group and Acting Assistant Managing Director of Digital Development Division Government Housing Bank (GHB) revealed that the GHB is ready to act in accordance with a set of measures to deal with financial fraud. Comply with Bank of Thailand (BOT) standards to oversee financial transactions and resolve issues for the public. especially customers of GHB who are a vulnerable group who can be victims of a financial disaster By accelerating the development of the bank’s system and technology fully and consistently. To prevent more diverse financial fraud transactions, such as sending links via fraudulent SMS, fake credit application call center gangs and money-sucking applications, etc., to prevent financial losses that may occur to the public.

We also place importance on communication to educate and create understanding for the Bank’s customers thoroughly, to the point, and easy to understand. In order to keep up with various scams of fraudsters, including a warning announcement that the Bank of Thailand has no policy to send SMS with links to mobile phone numbers of customers and the public. to invite financial transactions or offer special promotions And various discounts and rewards to customers through SMS channel is strictly prohibited and is ready to cooperate with relevant agencies in complying with the measures. or related regulations to be further prepared in order to increase the efficiency of solving such problems for the people in the future

Mr Thuanthong said that GHB customers have unusual transactions A transfer has been made from the account. where he or she is not a transferor or is suspected of being at risk of being lured into being a victim of fraud You can call the Financial Disaster Reporting Centre, GH Bank Call Centre, Tel 02-645-9000, press 33, every day, 24 hours a day.