Whoever has been nominated as the next governor of the Bank of Japan is less of a market authority than incumbent Haruhiko Kuroda. That could make some investors more aggressive in pushing yields higher after the governor change, said John Bale, chief global market strategist at Nikko Asset Management.

“Probably none of them are as determined and wicked as Mr. Kuroda. They may have the same philosophy, but they carry as much weight as Mr. Kuroda in continuing a very liberal policy under tremendous pressure. “There is no,” Bale analyzed.

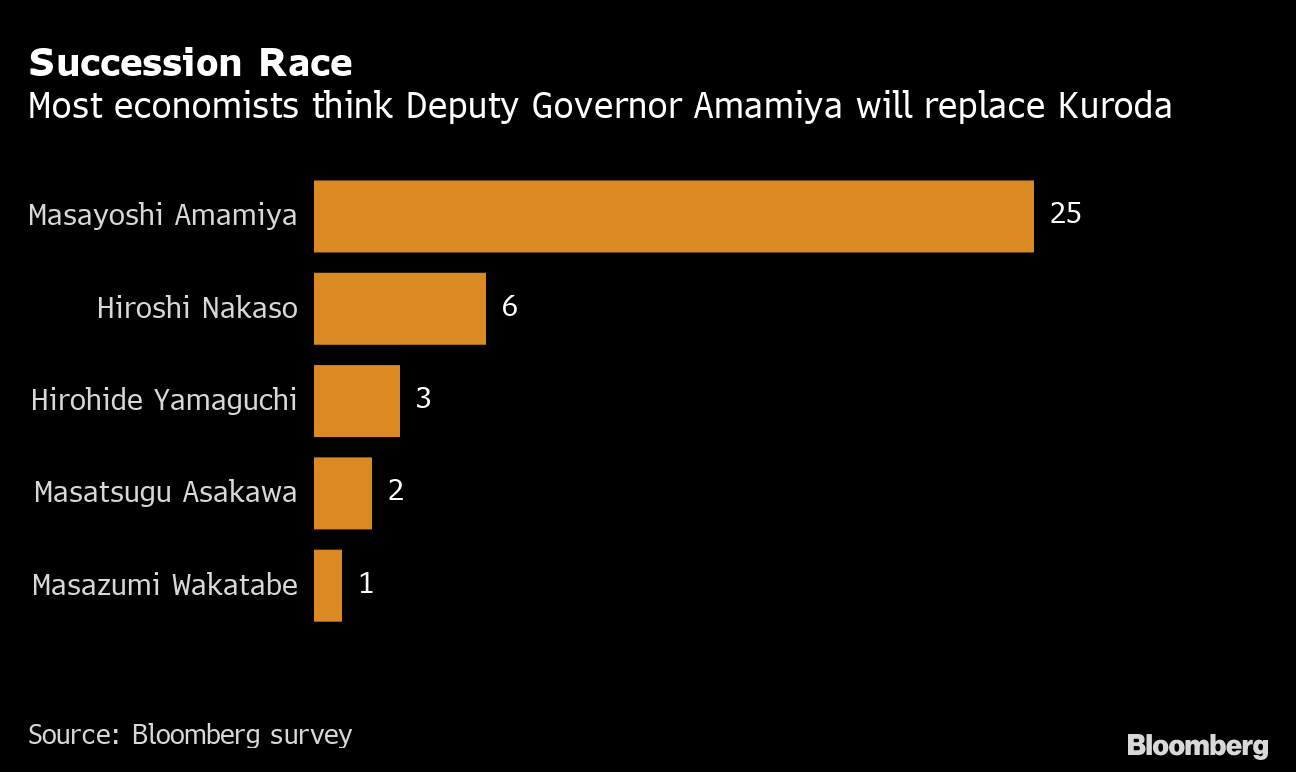

A recent Bloomberg survey of economists found that Kuroda’s successors include Vice Governor Masayoshi Amamiya, former Vice Governor Hiroshi Nakaso, GPIF chairman Hirohide Yamaguchi, and Asia’s Masatsugu Asakawa. Development Bank (ADB) Governor and Deputy Governor Masazumi names Wakatabe was mentioned.

Race of Succession

Most economists think Deputy Governor Amamiya will replace Kuroda

Source: Bloomberg Survey

Kuroda, whose season ends in April, has shown time and time again that he can keep an eye on the market. He was not afraid to go against other central banks in the world and was ready to surprise markets with bold policy changes.

As some traders urged the Bank of Japan to tighten its grip on raising yields, the central bank maintained its status quo on Thursday, sharply lowering yields on 10-year government bonds.

“Some traders would have learned a lesson,” said Mr Bale.

If inflation is at its peak, there’s a reason the incoming Fed governor won’t rush to roll back Kuroda’s policies, Bale said. The next Governor should hope that the awe of the market does not disappear anytime soon, he said.

Original title:Bond Bullies May Find BOJ a Softer Target After Kuroda Leaves (抜粋)