With concerns about the US recession remaining and the European economy stagnant, the resumption of economic activity in China will be a welcome factor in boosting the world economy.

However, unlike 2009, when the global economy recovered from the collapse caused by the collapse of Lehman Brothers, the Chinese government launched a large-scale stimulus package of 4 trillion yuan (about 77 trillion yen at the current rate) in the bank centralAt a time when we are rushing to curb inflation, there is also the worrying aspect that it could work in the direction of pushing prices up.

International Monetary Fund (IMF Managing Director Georgieva said earlier this month that China’s sudden change in its “zero-corona” policy was perhaps the most important factor for global growth this year, but she also warned of the implications for inflation.

Georgieva at the Annual Meeting of the World Economic Forum (WEF) (Davos), asked, “What if the good news about China’s faster economic growth leads to a significant increase in oil and gas prices, increasing inflationary pressures?”

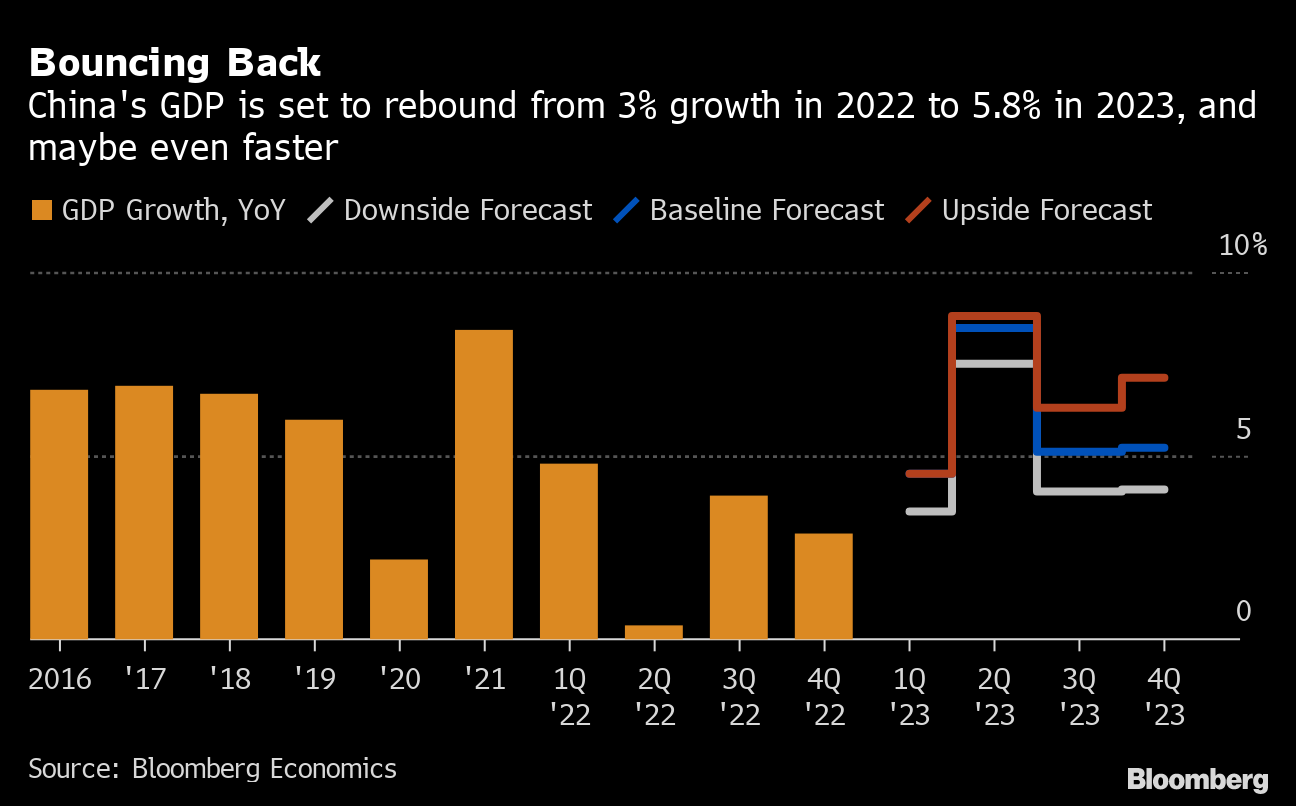

Bloomberg Economics (BE) shows China’s 23-year gross domestic product (The GDP growth rate is expected to recover to 5.8% from 3% in 2022. Modeling of the relationship between China’s economic growth, energy prices, and global inflation rates suggests that consumer prices in the fourth quarter of 2023 could be pushed up almost to 1 percentage point. If China’s economic growth accelerates further to 6.7%, this will reach around 2 points.

China’s economic activity is improving sharply, as shown by the January PMI

The shock of China

Forecasts for global CPI on different scenarios for China’s GDP growth 2023

Source: Bloomberg Economics

Given that the US consumer price index (CPI) was up 9.1% at one point last year, and 10.6% in the euro area at times, the impact may not seem like much. But in the context of the central bank’s single-minded focus on achieving its 2% inflation target, this is crucial.

If, as the BE model suggests, US inflation will remain around 5% in the second quarter (April-June) as the Chinese economy recovers, then the Federal Open Market in May will be able to thwart expectations of hold off on rate hikes at FOMC meetings.

There is a big difference between the Chinese economy, which is slowly under lockdown (city evacuation), and China, which is booming due to economic resumption, and to the world economy, an additional demand of 500 billion dollars (about 65 trillion yen), which is equivalent to the purchasing power of one country in Nigeria.

Commodity prices have risen in the form of such increased demand, while service and retail industries are bracing for a rebound in Chinese consumption.

It is true that a monotonous recovery in the Chinese economy is unlikely. The sudden change in the no corona policy towards the end of last year had a negative impact on economic activity. Uncertainty about infection and death rates has clouded public health costs and the economic outlook. Given that stimulus has been relatively subdued during the pandemic, it is unclear whether China will experience the kind of pent-up demand seen in other major economies.

Members transport a patient to an emergency outpatient clinic in Shanghai (December 23)

Photographer: Qilai Shen/Bloomberg

Factors such as Russian oil price caps, weather conditions in Europe, OPEC supply decisions and retail inventory trends will offset the impact of China’s economic resumption on global prices. It is a do-it-yourself situation.

But high-frequency data suggests that China’s economic collapse is already ending and the wave of coronavirus infections is settling. While visits to hospital emergency rooms are decreasing, subway ridership is increasing in major cities. Early data related to the Lunar New Year holiday showed that travel and movie box office revenues were much higher than the previous year.

Pan Mei, from Liuzhou City, Guangxi Zhuang Autonomous Region, was one of the people who enjoyed traveling during the Lunar New Year holiday. I visited Macau with my husband and sons to meet my eldest daughter, who is studying hard in Macau for her master’s degree.

“I have been forced to stay in mainland China for too long because of the pandemic,” Pan said.

It seems unlikely that a new wave of coronavirus infections will be avoided due to travel during the successive holidays, but due to improved vaccinations and natural immunity, about 1.4 billion Chinese people will be able to fight against coronavirus by the end of the quarter first (January-March) It is expected to increase resistance and adapt to symbiosis with corona. Lockdowns and restrictive measures will no longer hinder the economy.

Supportive measures for the real estate and technology sectors also add to the optimism.

Back on Track

The end of the Covid lockdowns, a pause in the technological conflict and support for property means a triple boost to growth

Source: Bloomberg

Since August 2020, when the Chinese government stepped up its efforts to stop a housing bubble and tightened its grip on property developers, the real estate sector, which has been the biggest contributor to the Chinese economy, has turned into a big drag. Property sales fell by 24% last year, investment fell by 10% and prices fell.

Chinese authorities are refocusing on increasing growth, improving cash flow to property developers and improving lending to home buyers. The long-term outlook remains bleak, including over-indebtedness in the real estate sector, but at least 2023 looks a little brighter. BE expects investment to fall by 3%, much less pressure on the economy than in 2022.

Chinese entrepreneurs are also being released. Since November 2020, when fintech giant Ant Group’s initial public offering (IPO) was cancelled, Chinese tech giants have faced huge fines and tightened regulations. The price of that tightening is high, with China’s Nasdaq Golden Dragon Index down about 80% from its peak in October.

But, as with the real estate sector, the Chinese government has decided that its near-term policy of reviving growth outweighs its long-term goal of curtailing the power of big players.

In Davos, Vice Prime Minister Liu pointed out that without the accumulation of wealth, collective prosperity would become “a river without headwaters, a tree without roots” and would not exist in the first place. He suggested the idea of taking new measures to support entrepreneurs. Tech stocks have rebounded somewhat.

That change of direction by China’s leaders is behind a sharp uptick in China’s economic outlook and officials are questioning the implications for inflation.

Bounce Back

China’s GDP is expected to rebound from 3% growth in 2022 to 5.8% in 2023, and perhaps even faster

Source: Bloomberg Economics

Inflationary pressures emanating from China will spread through two channels.

First, a series of absenteeism and factory closures due to the rapid spread of COVID-19 will make it difficult to continue operations, causing a supply shock. China’s Manufacturing Purchasing Managers’ Index (PMI) supplier supply index fell at the end of last year. There is a much lower risk of a repeat of the supply disruptions that led to the initial inflationary spike associated with the pandemic.

The second channel is the demand shock associated with a return to normal life and increased purchases. China’s oil imports were slow due to the corona crisis. Expectations of higher demand spread as people flocked to major roads, train stations and airport terminals, pushing oil prices up from $76 a barrel in early December to around $86 a barrel late this month. Jeff Curry, a veteran commodities analyst at Goldman Sachs Group Inc., said oil could rise above $105.

Channels of Inflation

A wave of infections is reaching delivery time for China’s factories. Looking ahead, China’s oil demand will get back on track

Sources: China National Bureau of Statistics, China Customs Administration

These supply and demand shocks could push global inflation almost a percentage point above the China-in-lockdown scenario at the end of 2023.

BE’s analysis suggests a boost of around 0.7 percentage points for the US, the euro area and the UK, which would be small compared to the global impact, but US monetary authorities , the European Central Bank (ECB), and the Bank of England (UK) enough to keep the central bank in tightening mode longer than the market expects.

Although there is still much uncertainty about the trajectory of the Chinese economy’s recovery and the trends of other factors influencing the global inflation rate, the direction is clear. China’s massive stimulus package at the height of the 2008 global financial crisis was undoubtedly positive for the global economy. On the other hand, the restart of the Chinese economy in 2023 is painful and painful.

news-rsf-original-reference paywall">Original title:The World’s Next Big Inflation Surprise Is Looming in China (抜粋)