An emergency light was switched on in memory of Korea’s main export product. The list is increasing to 20 weeks (about 5 months) due to a drop in demand amid the global economic downturn. A rebound in the second half also seems uncertain. Not only SK Hynix but also Samsung Electronics are worried about the possibility of losses.

According to the circumstances of the semiconductor industry on the 19th, the number of days in stock for domestic memory makers was confirmed to be 140 days (20 weeks). This is a figure that is much higher than the appropriate inventory level (5-6 weeks). It’s worse than the 10 shares of DRAM inventory and 14 shares of NAND flash stock estimated by the securities industry in the second half of last year. The number of days in inventory is an estimate of the time it takes from completion of production of finished semiconductor products to shipment, and is used as an indicator to determine when current inventory will become to end

The problem does not end there. 20 weeks is the manufacturer’s standard, so it has been observed that it is much more serious if the memory stock held by the actual customer is included. Smartphone, PC and server manufacturers tend to pre-purchase memory for smooth production of their products because memory is variable.

When customers are included, the inventory is analyzed to be stacked for up to 30 weeks, adding to the severity. This shows that it takes 7 to 8 months to process the current inventory when doing simple calculations. The cold wave in the blacksmith market is expected to continue into the second half.

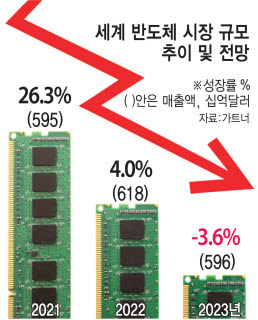

There are concerns about declining earnings at domestic semiconductor companies due to falling demand and rising inventory. The semiconductor industry predicts that SK Hynix’s performance in the fourth quarter of last year will be close to a loss. SK Hynix will announce its fourth quarter results on the 1st of next month.

Samsung Electronics, the world’s largest memory maker, also raises the possibility that its memory division will turn to a loss in 1Q. The last record loss in Samsung’s memory business was in the first quarter of 2009, 14 years ago. Samsung Electronics announced that its operating profit in the fourth quarter of last year fell by 69% compared to the same period last year.

A high-ranking official in the semiconductor industry said, “Looking at the current inventory level, there are more and more observations that it will be difficult for the market to recover in the second half of this year.” An official from another semiconductor company said, “Memory suppliers and customers are both getting angry about inventory management.”

Reporter Dongjun Kwon djkwon@etnews.com