Post ‘Sell’ on Twitter right before FOMC

Concerns about bubbles in financial markets from 2019

CNBC’s Jim Kramer: “There’s a bull market right now”

Voices recommended selling while the US stock market showed an upward trend last month on expectations that inflation would be contained.

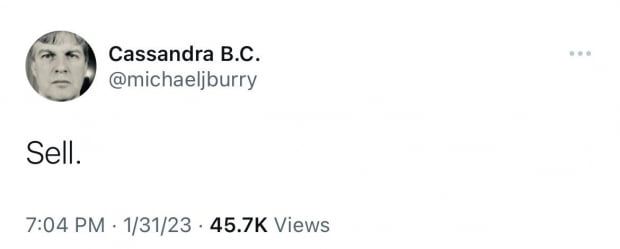

At 9:00 am on the 1st (local time), Michael Berry, founder of hedge fund Science Asset Management, “Sell”posted on Twitter. It was only a few hours before the US Central Bank (Fed) opened the Federal Open Market Committee (FOMC) and raised the base rate by 0.25 percentage points. He did not explain why he had to sell. Berry deleted his current Twitter account and took down the post.

Michael Bury is famous for being a real person who starred in the film ‘The Big Short’. During the financial crisis of 2007-2008, he was one of the investors who made huge profits by investing in a “short position (short sale)” after correctly predicting the collapse of the US real estate market.

It is analyzed that the expectation that the Fed will stop raising interest rates has existed in the market. Last month, the S&P 500 index rose 6.2%. This is the highest since January 2019. The Dow Jones Industrial Average rose 2.83%. The Nasdaq jumped 10%, its biggest gain since 2001.

Unlike optimistic investors, Mr Burry was concerned about a bubble crisis. On the 24th of last month, he posted the S&P 500 chart at the time of the 2001 dot-com bubble on his account, and highlighted a temporary rebound point with a red circle. After the rebound, the index plunged. It is noted that the upward rally that appeared last month was only a temporary rebound.

Burry has been concerned about a bubble in the stock and bond markets since 2019. It is argued that it is overvalued due to index tracking funds and ETFs. In 2021, he predicted the collapse of the cryptocurrency bubble, and last year, he suggested that passive investment would cause a crisis. Science Asset Management, which he runs, is a private prison operator last year. Geo GroupAlmost all of his assets were sold except .

“There is the biggest speculative bubble of all,” he said in November, stressing that “in the long run, it will lead to years of recession.”

Not only CEO Burry, but also experts recommend selling liners. JPMorgan’s Marko Kolanovich and Morgan Stanley’s chief investment officer (CIO) Mike Wilson have analyzed that the recent upswing is only a temporary rebound and that the bear market will last for a long time.

On the other hand, CNBC host Jim Kramer refuted the experts’ comments. As the host of CNBC’s signature program ‘Mad Money’, he emphasized, “The stock market appears to be in a bull market right now,” and that it is “time to buy at a low point.”

Reporter Oh Hyun-woo ohw@hankyung.com