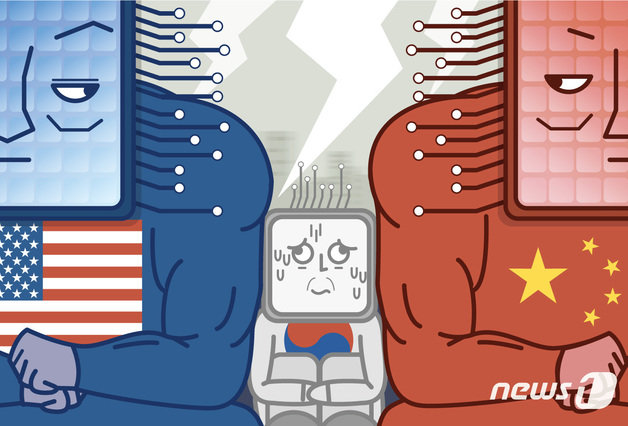

A request for investment subsidies for semiconductor production facilities in the United States has begun. However, Samsung Electronics (005930) and SK Hynix (000660) are still struggling. It is difficult to apply for the subsidy blindly, and it is burdensome to refuse to receive it.

At least SK Hynix, whose application period is still on, can afford to take stock of the situation, but Samsung Electronics, which is already building a factory, is in a hurry. The remaining key is persuasion. Governments and semiconductor companies are expected to negotiate to lower the US government’s requirements.

On the 31st (local time), the US Department of Commerce began accepting grant applications for state-of-the-art semiconductor manufacturing facilities. Legacy (maturity process) or post-process manufacturing facilities can apply from 26 June.

When semiconductor companies apply for subsidies, the US Department of Commerce will comprehensively review the economy and national security, as well as financial status, investment capabilities, and workforce plans.

The problem is that strict conditions must be met in order to receive subsidies. If subsidies are received, the expansion of semiconductor production facilities in countries of concern, such as China, will be restricted for 10 years from the date of receipt. In the case of advanced semiconductors, it is restricted from expanding production capacity by more than 5% (10% for legacy semiconductors) within 10 years.

The Wall Street Journal (WSJ) analyzed that the guardrail regulations would burden Samsung Electronics Korea and SK Hynix and Taiwan’s TSMC, which operate factories in China.

In addition, profitability indicators such as expected cash flow and company products must be presented as an Excel file, and a certain proportion must be returned in case of excess profit. In fact, the industry view is that it is a bid to reveal the trade secrets of semiconductor companies.

Semiconductor companies are in a difficult position. At least SK Hynix, whose application deadline starts in June, has room to spare, but Samsung Electronics is in a hurry.

Samsung Electronics Semiconductor Plant Construction Site in Taylor City, Texas

Samsung Electronics is currently building a $17 billion state-of-the-art semiconductor manufacturing plant in Taylor, Texas. Last year, it also announced plans to invest in a $200 billion semiconductor manufacturing plant.

Applying for subsidies not only restricts business in China, but also raises concerns about disclosure of trade secrets. In response, Samsung Electronics only repeats a cautious response, saying, “We intend to closely review the situation and establish a response direction.”

On the other hand, SK Hynix, which promotes the construction of a memory packaging factory (back-end process), has relatively little time, as the application period begins on June 26.

However, SK Hynix Vice Chairman Park Jung-ho met with reporters at a recent shareholder meeting and expressed frustration, saying, “I am considering whether to apply for a US semiconductor subsidy.”

Companies are pinning their hopes on further persuading the US government. If Samsung Electronics or TSMC does not apply for subsidies under difficult conditions, it is necessary to actively draw attention to the fact that the US government’s semiconductor aid law itself may become useless and obtain additional relief.

TSMC Chairman Liu De-yin said at a conference held by the Taiwan Semiconductor Industry Association on the 30th (local time) that there were “some unacceptable conditions” regarding US semiconductor subsidies. We will talk to the US government,” he said.

President Yoon Seok-yeol also met with US Trade Representative Catherine Thai on the 30th and asked for an easing of conditions, saying, “There are concerns among Korean companies about providing excessive levels of information.”

(Seoul = News 1)

/cloudfront-ap-northeast-1.images.arcpublishing.com/chosun/XSVDUY2CPJLKRMSPK5R4UHLQWU.jpg?fit=300%2C300&ssl=1)