Bitcoin‘s Price Struggles Below $85,000 Amidst Shifting Investor Sentiment

Table of Contents

- Bitcoin’s Price Struggles Below $85,000 Amidst Shifting Investor Sentiment

- Bitcoin’s Price Struggles: Navigating Investor Sentiment and Market hurdles

- What’s Happening with Bitcoin’s Price Right Now?

- Why is Bitcoin Below $85,000?

- What Does Bitcoin Velocity Tell Us About Investor behavior?

- What’s Driving This Cautious Sentiment?

- Are Bitcoin Investors Still Optimistic?

- What Does Long-Term Holder Behavior Signify For Bitcoin?

- Can Bitcoin Recover from Recent Losses?

- What are the Potential Risks for Bitcoin?

Bitcoin’s price has faced headwinds as late February, struggling to break above $85,000. While recent price action suggests stability below this critical level, underlying investor sentiment reveals a nuanced picture.

Bitcoin Investors Show Long-Term Optimism

Bitcoin “velocity,” a measure of how quickly the cryptocurrency circulates, hit a five-month low last week. This slowdown indicates that Bitcoin holders are becoming more cautious, with fewer tokens being actively traded.

Typically, decreased circulation can restrain price growth, a trend Bitcoin has recently experienced.

The decline in velocity reflects a potential shift in investor sentiment, with increased doubt among market participants. This caution contributes to a slower recovery in Bitcoin’s price.

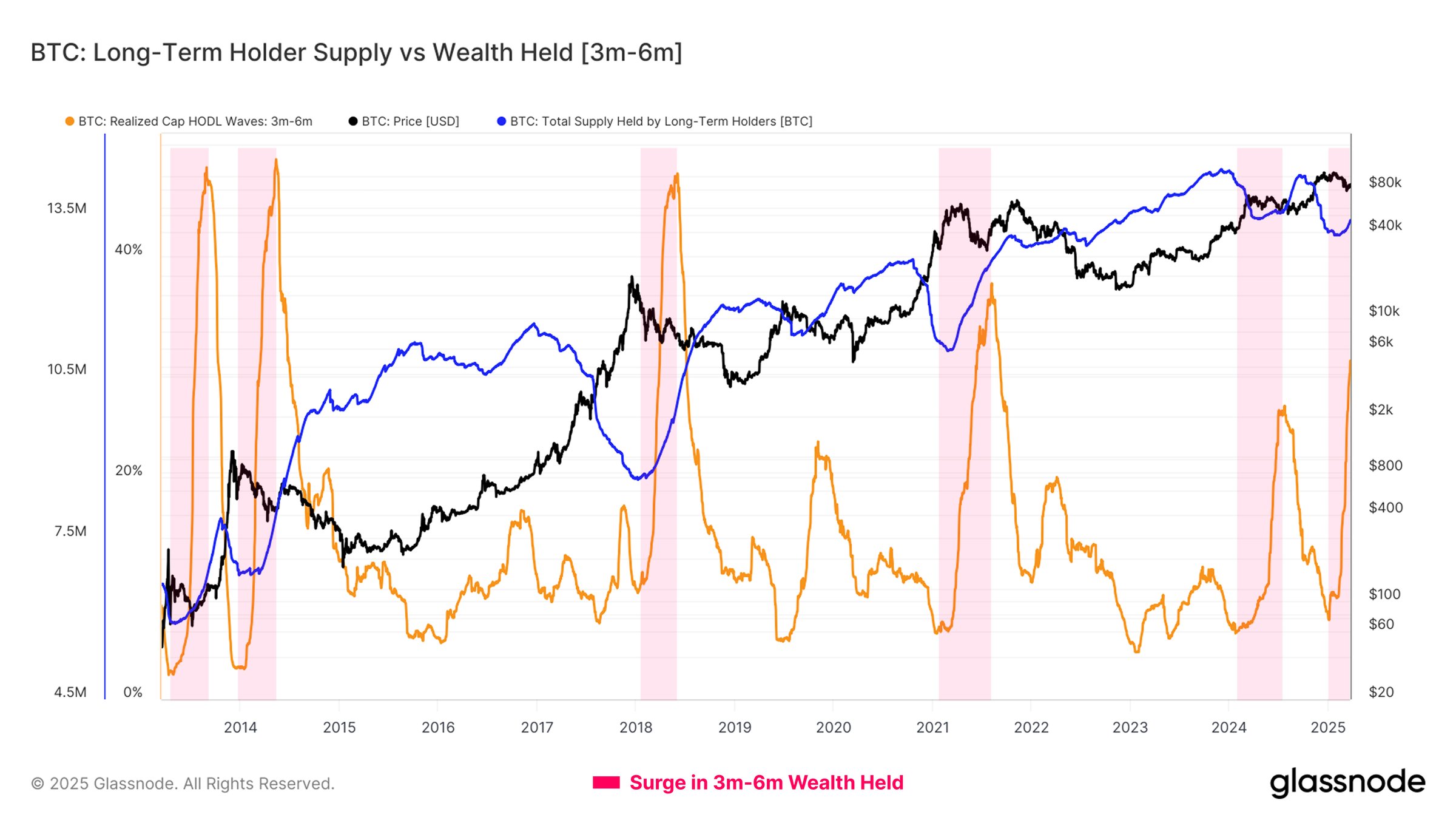

However, mid-term holders (those holding for three to six months) have seen an increase in their holdings during this period, with many transitioning into long-term holders (LTH). This suggests a growing confidence among a segment of investors.

Many of these tokens were acquired when Bitcoin reached its all-time high, and their continued holding signals a strong belief in the asset’s long-term potential.

Spending from this long-term holder group has reached its lowest level since mid-2021, indicating a reluctance to sell, even during market uncertainty.

reduced selling pressure can be a positive sign, suggesting that key investors are committed to their positions and are not deterred by market downturns.

Can Bitcoin Recover From Recent Losses?

As of today, Bitcoin is trading at $83,403, just below the crucial resistance level of $85,000. Earlier this week,it briefly surged to $88,500 before falling back following news of potential tariff actions. While this caused a temporary dip in market sentiment, prices have remained relatively stable above $80,000.

Bitcoin’s near-term recovery hinges on continued support from long-term holders. Overcoming the $85,000 resistance and establishing it as a support level is crucial. A confirmed recovery would be signaled by Bitcoin surpassing $89,800,possibly paving the way for further gains.

However, if Bitcoin fails to break thru $85,000 and circulation remains low, the price could retreat to the next key support level at $80,301. Such a decline would negate bullish prospects and could lead to further consolidation or bearish price action in the short term.

the content below is derived from the provided article and should be considered as investment research. This is not financial advice.Always conduct your own research before making financial decisions.

What’s Happening with Bitcoin’s Price Right Now?

Bitcoin’s price is currently facing a challenge. As of the provided data, Bitcoin is trading around $83,403, just below the crucial $85,000 resistance level. This struggle reflects broader market dynamics and investor sentiment.

Why is Bitcoin Below $85,000?

the article states that Bitcoin has been struggling to break above the $85,000 mark.While the price briefly surged to $88,500 earlier in the week, it retreated following news that may have impacted confidence. This shows the impact of events on market movements.

What Does Bitcoin Velocity Tell Us About Investor behavior?

Bitcoin “velocity,” a measure of how quickly Bitcoin circulates, hit a five-month low. this indicates a slowdown in trading activity and suggests that holders are becoming more cautious. Fewer tokens being actively traded can restrain price growth.

What’s Driving This Cautious Sentiment?

The decline in Bitcoin’s velocity points towards a potential shift in investor sentiment. Increased doubt among market participants and a general sense of caution are contributing to a slower recovery in Bitcoin’s price.

Are Bitcoin Investors Still Optimistic?

Yes,a key indicator of optimism is the behavior of mid-term holders (those holding for three to six months). They have increased thier holdings during this period, with many transitioning into long-term holders (LTH). This suggests a growing confidence among a segment of investors.

What Does Long-Term Holder Behavior Signify For Bitcoin?

long-term holders’ behavior is quite significant.Many of these tokens were acquired near bitcoin’s all-time high. The continued holding of these tokens signals a strong belief in the asset’s long-term potential.Also, reduced selling pressure from this group – spending from this group has reached its lowest level since mid-2021 – is a positive sign.It suggests commitment and resilience to market downturns.

Can Bitcoin Recover from Recent Losses?

Yes, Bitcoin’s near-term recovery hinges on continued support from long-term holders. Overcoming the $85,000 resistance and establishing it as a support level is crucial. A confirmed recovery would be signaled by Bitcoin surpassing $89,800, potentially paving the way for further gains.

What are the Potential Risks for Bitcoin?

If Bitcoin fails to break through the $85,000 level and circulation remains low, the price could retreat to the next key support level at $80,301. Such a decline would negate bullish prospects and might lead to further consolidation or bearish price action in the short term.