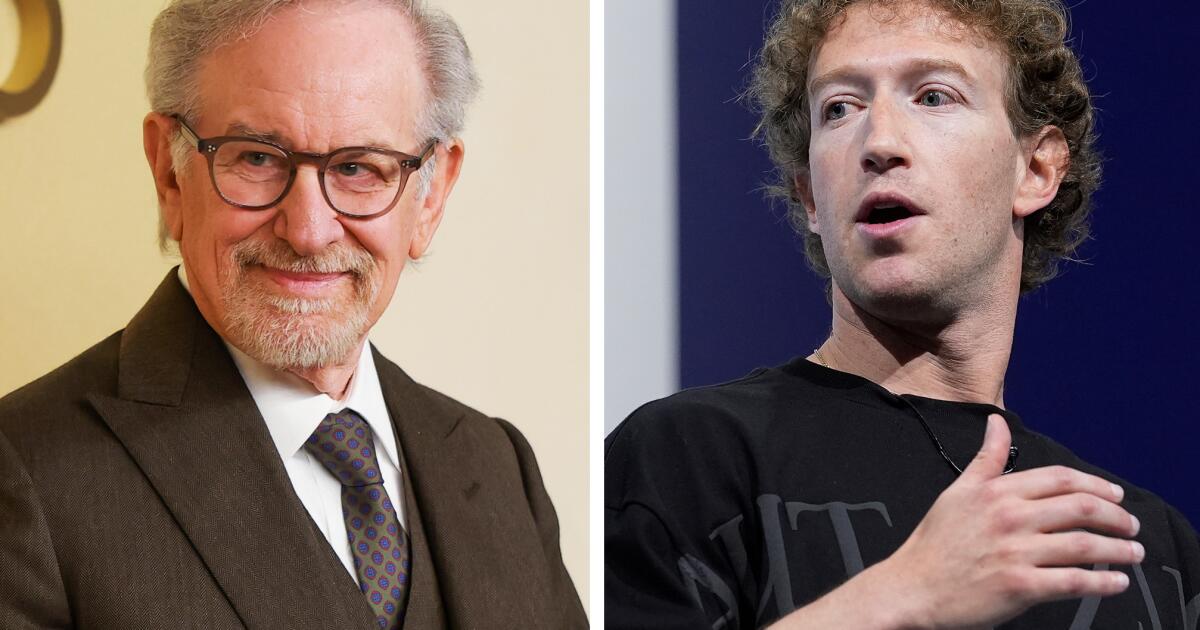

California’s potential loss of two of its most prominent residents – filmmaker Steven Spielberg and Facebook founder Mark Zuckerberg – is stirring speculation about the impact of a proposed wealth tax on the state’s wealthiest citizens. While neither has explicitly linked their moves to the tax proposal, their decisions come as supporters gather signatures to qualify the initiative for the November ballot.

Spielberg has officially relocated to New York City, settling into a residence in the prestigious San Remo co-op on Central Park West. The move, long-planned according to a spokesperson, is driven by a desire to be closer to his children and grandchildren. “Steven’s move to the East Coast is both long-planned and driven purely by his and Kate Capshaw’s desire to be closer to their New York based children and grandchildren,” said Terry Press, a spokesperson for the filmmaker. Amblin Entertainment has also opened an office in New York.

Meanwhile, Zuckerberg is reportedly considering a $200 million waterfront mansion in South Florida’s exclusive Indian Creek, a gated island community home to other high-profile figures like Amazon’s Jeff Bezos and Ivanka Trump. Representatives for Zuckerberg have not commented on the potential purchase.

The proposed tax, backed by the Service Employees International Union-United Healthcare Workers West (SEIU-UHW), aims to levy a 5% one-time tax on the assets of California billionaires and trusts, generating an estimated $100 billion. The funds would be largely allocated to healthcare services and some education programs. The initiative is facing opposition from those who argue it will drive wealthy individuals and businesses out of the state.

The timing of Spielberg and Zuckerberg’s potential departures echoes concerns raised by other wealthy Californians who have recently relocated, citing the state’s tax policies and regulatory environment. Venture capitalist David Sacks announced the opening of an Austin, Texas office on December 31, the same day Peter Thiel publicized his firm’s new Miami location. However, unlike those individuals, neither Spielberg nor Zuckerberg has publicly attributed their moves to the proposed tax.

The debate surrounding the wealth tax is also creating divisions within the Democratic party, particularly as the 2026 gubernatorial race approaches. Governor Gavin Newsom, who is term-limited and considering a presidential run, opposes the measure. Senator Bernie Sanders, however, publicly campaigned in support of the tax in Los Angeles on February 11, stating, “I am not only supportive of what they’re trying to do in California, but we’re going to introduce a wealth tax for the whole country. We have got to deal with the greed, the extraordinary greed, of the billionaire class.”

Both Spielberg and Zuckerberg are significant political donors, though tracking the full extent of their contributions is complex due to various donation methods and reporting requirements. Spielberg, worth over $7 billion according to Forbes, has historically donated almost exclusively to Democratic candidates and causes. He built his career after dropping out of Cal State Long Beach when Universal Studios offered him a directing contract.

Zuckerberg, valued at over $219 billion by Forbes, has a more varied donation history, contributing to both Democrats and Republicans, including figures like former House Speaker Nancy Pelosi, Senate Minority Leader Chuck Schumer and even President Trump’s Secretary of State Marco Rubio and former New Jersey Governor Chris Christie. Meta, Facebook’s parent company, also donated $1 million to Trump’s 2024 inauguration committee.

Zuckerberg’s connection to California began during his time at Harvard University, where he developed the early prototype of Facebook before relocating to Silicon Valley to launch the platform. He continues to own properties in California, including a substantial compound on Kauai featuring multiple residences, buildings, and even an underground bunker. Meta remains headquartered in Menlo Park, California, despite being incorporated in Delaware.

The potential impact of a mass exodus of wealthy Californians on state revenue is a significant concern. California’s budget is heavily reliant on taxes paid by its highest-income residents, particularly from capital gains and stock-based compensation. According to Governor Newsom’s 2026-27 budget summary, “The significant share of personal income taxes — by far the state’s largest General Fund revenue source — paid by a small percentage of taxpayers increases the difficulty of forecasting personal income tax revenue.”

Determining residency for tax purposes in California is not straightforward. The Franchise Tax Board considers factors such as voter registration, principal residence, time spent in the state, driver’s license and vehicle registration, location of family members, healthcare providers, and “social ties.” Whether the proposed tax will even qualify for the November ballot, and if approved, whether it will lead to a significant outflow of wealth, remains to be seen. However, the moves by figures like Spielberg and Zuckerberg are undoubtedly adding fuel to the debate.