Financial Supervisory Service Announces Plan to Strengthen Inspection System in Financial Investment Sector

Financial Supervisory Service aims to expel illegal and insolvent financial investment companies

The Financial Supervisory Service (FSS) unveiled a comprehensive plan to revamp the inspection system in the financial investment sector, with the primary objective of tackling illegal activities and eliminating poor-performing companies. This move comes as part of FSS’s commitment to safeguarding the interests of customers and restoring public confidence in the market.

Under the new plan, the FSS will implement a zero-tolerance approach towards gold investment companies that systematically harm customer interests or engage in large-scale theft or breach of trust. Even a single violation in such cases will result in immediate cancellation of registration. Additionally, the FSS has raised the standards for classifying non-business conduct to prevent companies from avoiding regulatory action. These measures aim to address concerns over the delayed expulsion of insolvent and illegal companies, thus ensuring timely action against them in the future.

To enhance inspection capabilities, the FSS will remove industry differences in its financial investment inspection departments and bolster the number of inspection personnel. The restructuring will consolidate the existing Financial Investment Inspection Office, Asset Management Inspection Office, and Special Inspection Unit for Private Placement Management into Financial Investment Inspection Centers 1, 2, and 3, respectively. This overhaul will not only eliminate industry discrepancies but also increase interconnectivity among the various inspection units.

The number of inspection teams will rise from 13 to 15, accompanied by an increase in inspection personnel from 60 to 80. This expanded workforce will facilitate more effective and efficient inspections, enabling the FSS to better fulfill its regulatory duties.

In line with the reform plan, the FSS has also announced a change in its approach to prosecution. Going forward, the focus will shift from “institution-focused” to “case-related” prosecution. Furthermore, prosecutors from three countries will be brought in expeditiously to tackle urgent and delicate cases in order to target and mitigate serious offenses in the sector.

The need for these reforms has become increasingly evident due to a surge in the number of companies subject to inspection, which rose from 328 at the end of 2012 to 893 as of last year’s end. This uptick in inspection targets has coincided with a rise in illegal activities, resulting in complex investigations involving multiple companies. Consequently, the FSS has taken proactive steps to address these challenges and ensure the smooth functioning of the market.

Effective from the 13th of this month, the reform plan will be implemented in close coordination with both the financial investment industry and the Financial Services Commission. The FSS aims to establish a flexible and responsive inspection system that can adapt to the rapidly changing capital market landscape. By eliminating illegal business practices and promoting market transparency, the FSS is committed to restoring public trust and maintaining order in the capital market.

Overall, these reforms underscore the FSS’s unwavering commitment to maintaining integrity and stability within the financial investment sector as it continues to foster a conducive environment for investors.

Correspondent: Kim Hwan

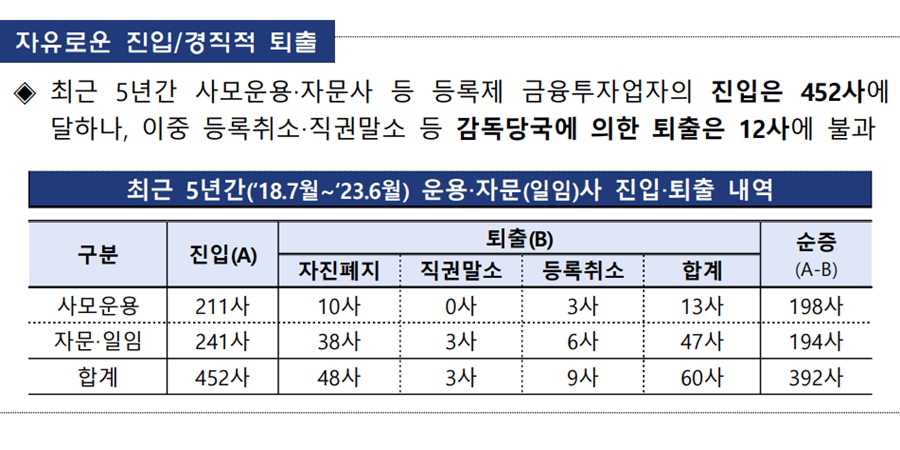

▲ The Financial Supervision Service announced a plan to reform the inspection system of the financial investment sector to expel illegal or insolvent financial investment companies immediately. The picture shows the latest gold investment entry and exit statistics released by the Financial Supervisory Service. <금융감독원>

[비즈니스포스트] The Financial Supervisory Service has decided to strengthen inspections of illegal and poor financial investment companies and expel inappropriate companies.

On the 9th, the Financial Supervision Service presented a plan to reform the inspection system of the financial investment sector, which includes one strike against illegal and insolvent gold investors, strengthening inspection capabilities, and changing inspection methods.

First, if a gold investment company is deemed to have systematically harmed the interests of customers at the company level or committed large-scale theft or breach of trust, the registration will be immediately canceled even for one violation. The standards for determining non-business conduct have been raised, preventing actions that avoid ex officio cancellation.

The Financial Supervisory Service explained that there were concerns about damage to investors as insolvent and illegal companies were not being expelled in a timely manner due to the limited expulsion standards. Accordingly, it was decided to strengthen the process of expelling illegal and insolvent gold investment companies in a timely manner in the future.

Inspection capabilities will also be strengthened. Industry differences between financial investment inspection departments will be eliminated and inspection personnel will increase.

The organization of the Financial Supervision Service, divided into the Financial Investment Inspection Office which is responsible for securities companies, the Asset Management Inspection Office which is responsible for managers of public offers, and the Special Inspection Unit for Private Placement Management which is responsible for private placement management companies, are being reorganized into Financial Investment Inspection Centers 1, 2, and 3.

The newly established Financial Investment Inspection Centers 1, 2, and 3 will all be responsible for securities firms and private equity management firms, eliminating industry differences and increasing connectivity.

The number of inspection teams will increase from the current 13 to 15, and the number of inspection personnel will also increase from 60 to 80.

In addition, prosecutors will change from ‘institution-focused prosecutors’ to ‘case-related prosecutors’ in the future, and prosecutors from three countries will be intensively used immediately to target serious sectors , urgent and fragile.

The Financial Supervisory Service explained that it had prepared this reorganization plan as the number of companies subject to inspection increased rapidly from 328 at the end of 2012 to 893 at the end of last year, illegal activities also increased, and complex cases involving multiple companies as well. .

The reform plan comes into effect on the 13th. To prevent confusion, co-operation is being made not only with the financial investment industry but also with the Financial Services Commission.

The Financial Supervisory Service said, “We will establish an inspection system that can respond flexibly to rapidly changing capital market situations by reforming the financial investment inspection system,” and added, “We will do our best to ensure the order of the market by eliminating illegal business practices. and restore public confidence in the capital market.” “I’ll do my best,” he said. Correspondent Kim Hwan

#Introducing #oneshot #largescale #theft #breach #trust #financial #investment #firms #strengthening #Financial #Supervisory #Services #inspection #capabilities

.jpg?fit=300%2C300&ssl=1)

/cloudfront-ap-northeast-1.images.arcpublishing.com/chosun/7NT2NT6PR5EOHOC3LXEKCZVBOI.png?fit=300%2C300&ssl=1)