Normalization after one 12 months of incorporation in Hanwha Group

Give attention to excessive added worth vessels similar to LNG carriers

Company worth greater than KRW 9 trillion, development tripled

Weighing Austal acquisition, and so forth.

Focus funding capabilities on the maritime and protection industries

Burden as a result of smaller variety of orders than opponents

Hanwha Ocean, which celebrates its first anniversary on the twenty third, accelerates the normalization of administration by eradicating the shadow of its predecessor, Daewoo Shipbuilding & Marine Engineering, which was thought-about a consultant bancrupt firm previously. With monetary indicators beginning to enhance in earnest due to a selective order-taking technique that warns towards low-priced orders and an improved administration construction, the corporate is poised to show an annual surplus for the primary time in 4 years. Primarily based on this, Hanwha Ocean goals to develop its enterprise portfolio, which beforehand targeted on service provider delivery, by actively pursuing company mergers and acquisitions (M&A) within the maritime and protection industries.

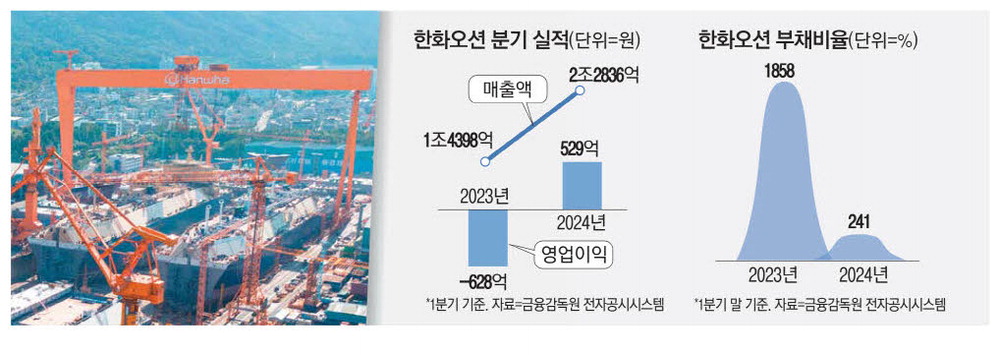

Hanwha Ocean’s working revenue consensus for this 12 months, compiled by monetary data firm FnGuide on the twenty second, is anticipated to earn 287.2 billion, reaching its first annual surplus since 2021. In comparison with the time when Daewoo Shipbuilding and Marine Engineering on the crossroads of life and dying, recording an working lack of over 1 trillion gained in 2021 and 2022 attributable to lax administration and low value orders beneath the Korea Growth Financial institution KDB system. Hanwha Ocean recorded an working revenue of 74.1 billion gained within the third quarter of final 12 months, reaching a quarterly surplus for the primary time in 12 quarters. Hanwha Ocean is assessed to have been in a position to rapidly normalize its administration due to its technique of successful selective orders targeted on profitability and its fast return to regular manufacturing pace, which had suffered difficulties. Since its launch, Hanwha Ocean has targeted its orders on excessive value-added vessels similar to liquefied pure fuel (LNG) carriers and really giant ammonia carriers (VLAC). As well as, we’re actively concerned in hiring to compensate for delays within the course of attributable to a scarcity of manpower. first quarter of this 12 months, and productiveness is enhancing quickly. The impression of being integrated into the Hanwha Group was additionally vital. With the participation of associated teams similar to Hanwha Aerospace, Hanwha Ocean secured funds by efficiently growing the paid-up capital value 1.5 trillion gained final 12 months. As a result of transfusion of the fund along with an enchancment within the structure, the debt ratio, which was near 1858% within the first quarter of 2023, stabilized at 241% within the first quarter of this 12 months. The market capitalization, which was about 3 trillion gained on the time of its incorporation into Hanwha Group, had tripled to 9.2827 trillion gained on the twenty second.

Hanwha Ocean’s aim this 12 months is to normalize administration and develop its enterprise portfolio into maritime and protection fields. Current investments have come from the maritime sector. Final month, it invested a complete of KRW 402.5 billion to accumulate the wind energy enterprise of the Hanwha Development Division, the group’s holding firm, and the plant enterprise of the worldwide division, and this month, it spent KRW 91 billion to safe a 21.5% stake at Dynamac Holdings, a Singapore-based producer of floating marine merchandise. Within the case of the protection enterprise, the corporate is at the moment pursuing the acquisition of Austal, an Australian shipbuilding and protection firm that owns a shipyard in america, in an effort to enter the upkeep market and US warship restore (MRO) value 20 trillion. win yearly.

Nevertheless, there are voices within the shipbuilding and protection industries that query whether or not Hanwha Ocean will have the ability to obtain sustainable development sooner or later, given its latest poor efficiency in business ship orders. Hanwha Ocean’s ship orders final 12 months totaled $3.5 billion (about KRW 4.7 trillion), considerably behind rivals HD Korea Shipbuilding & Marine Engineering (USD 22.6 billion) and Samsung Heavy Industries (USD 8.3 billion). This 12 months, on Might 22, it has recorded orders value $3.3 billion, rating final among the many three shipbuilding corporations.

[최현재 기자]

When you preferred this text, Click on like.

nice

nice 0

#Hanwha #Ocean #bother.. #billion #inexperienced #lights #left