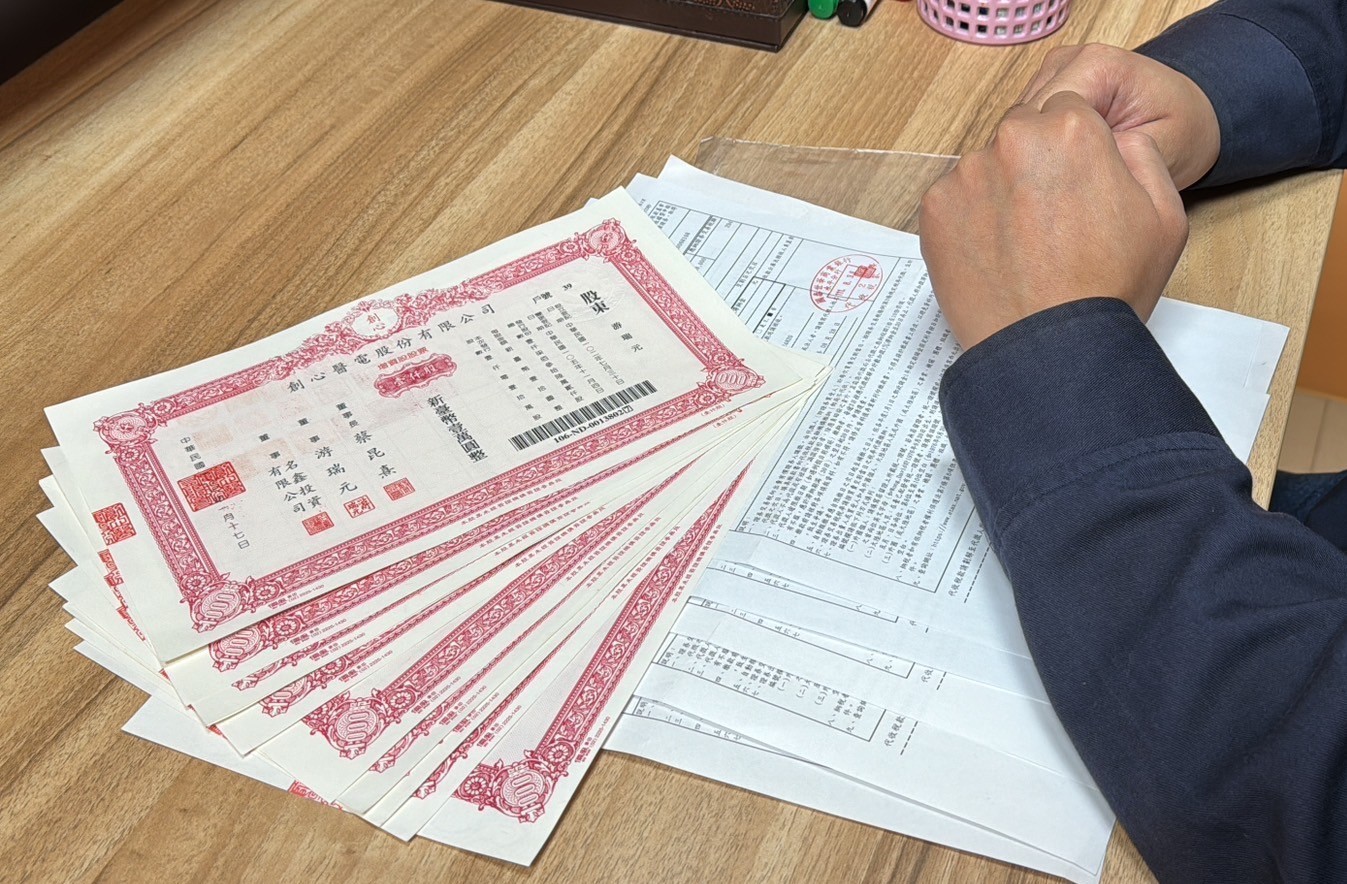

Although the Taiwan stock market suffered a stock market crash today, the previous market was enthusiastic, except for listed (counter) companies.stockIn addition to trading, many investors also buy and sell shares of unlisted (over-the-counter) companies.The Kaohsiung National Taxation Bureau of the Ministry of Finance stated that according to Securitiestransaction taxIt stipulates that when buying and selling securities, except for bonds issued by governments at all levels, securities transaction taxes should be levied in accordance with the law.

For example, the Kaohsiung National Taxation Bureau said that the securities seller Mr. Wang sold 10,000 shares of unlisted (counter) A Co., Ltd. (Company A) to Ms. Zhang on April 2, 2013. The transaction price per share was 20 yuan. If Company A The stock is based oncompany lawThe shares of Company A are entity stocks issued under a required visa, or non-entity stocks issued in accordance with the provisions of the Company Law. Company A’s shares are “securities” as referred to in the Securities Transaction Tax Regulations.

Therefore, Mr. Wang’s sale of Company A’s shares is a securities transaction, and Ms. Zhang should collect securities transaction tax of 600 yuan (i.e., the transaction price per share of 20 yuan multiplied by the number of shares traded) on the day of transaction and settlement (April 2, 2013). 10,000 shares multiplied by the tax rate of 3‰), and the payment form should be filled in and paid to the treasury on the next day (April 3, 2013).

According to the tax bureau’s explanation, the so-called “marketable securities” refer to bonds issued by governments at all levels, companies issuing stocks, corporate bonds, and other securities that are publicly offered and sold with government approval. The above-mentioned buying and selling of “stocks issued by the company” refers to the buying and selling of physical stocks printed and issued by a bank in accordance with Article 162 of the Company Act, or the shares issued by the company that have been contacted by a centralized securities depository institution in accordance with Article 161-2 of the Company Act. Registered non-physical stocks are all securities transactions, and securities transaction tax should be levied in accordance with the securities transaction tax regulations.

If the stock is directly transferred by the holder to the transferee, the transferee (i.e. the buyer) shall levy the securities transaction tax at the prescribed tax rate on the day of transaction and settlement, and shall pay the securities transaction tax to the treasury on the day after the collection.

The Kaohsiung National Taxation Bureau reminds that when private parties directly buy and sell the stocks of unlisted (counter) companies, they can first confirm with the invested company. If the company’s stocks are issued in accordance with the provisions of the Company Law, they will be subject to the securities transaction tax. The buyer The (collector) shall collect the securities transaction tax on the day of sale and delivery and pay the tax to the national treasury on the next day.

If you pay inheritance tax first, be careful that one missed move may turn it into a “gift” and you need to pay tax.

The Kaohsiung National Taxation Bureau of the Ministry of Finance stated that the heir paid the inheritance tax with his own bank deposit and did not seek compensation from other heirs. According to the provisions of Article 5, Paragraph 1 of the Inheritance and Gift Tax Law, the statute of limitations for the right of claim…

2024-04-19 18:23

Kaohsiung National Taxation Bureau for private trading of unlisted stocks: you also have to pay certification tax

Although the Taiwan stock market suffered a stock market crash today, the market was previously very active. In addition to trading in the stocks of listed (over-the-counter) companies, many investors also bought and sold the stocks of unlisted (over-the-counter) companies. Ministry of Finance Kaohsiung National…

2024-04-19 17:07

Is it New Taipei’s turn to cut leeks? Overtaking Taichung and becoming the “Tax King” in March

According to the tax statistics of the Ministry of Finance’s statistical database, in March this year, the combined tax revenue from personal real estate and land was 4.24 billion yuan, setting a new high for the same period in history. What is different from the past is that in the past, Taichung City often paid…

2024-04-19 11:53

The Political Yuan has made a decision…the salary increase tax credit will be deferred for 10 years to hire more people over 45 years old

Measures such as the Ministry of Economic Affairs’ “Small and Medium Enterprise Development Ordinance”, which include tax incentives for employees to increase their salary, will expire on May 19th. The Executive Yuan passed a draft amendment yesterday to extend tax incentives for ten years…

2024-04-19 05:36

There are four ways for enterprises to report depreciation expenses and save taxes. The averaging method is more suitable for four situations, including loss or new start-up.

The Ministry of Finance stated that when enterprises report depreciation expenses in accordance with tax laws, they can select or change appropriate depreciation methods based on the company’s own business conditions to achieve tax savings.

2024-04-19 00:46

Pay attention to tax issues when using grants to buy a house from your parents, and prepare a complete payment process and proof of payment.

Parents often use the annual gift tax exemption of 2.44 million per person to contribute money to reduce the burden of purchasing a house for their children in the future. If a child buys a house from his father with a grant, he should have sufficient funds to pay it off…

2024-04-19 00:45

0 messages in total

- When posting articles or placing tags, you must not make any remarks that are illegal or infringe upon the rights of others. Violators shall bear legal responsibility.

- For comments that are knowingly untrue or excessively emotional and abusive, if reported by netizens or discovered by this website, Lianhe News Network has the right to delete the article, suspend or terminate the membership. If you do not agree with the above rules, please do not post articles.

- For tags that are meaningless, irrelevant to this article, knowingly untrue, or abusive, Lianhe News Network reserves the right to delete tags, suspend or cancel membership. If you do not agree with the above regulations, please do not place tags.

- If the “nickname” involves swearing, swearing, or infringing on the rights of others, Lianhe News Network has the right to delete the article, suspend or cancel the membership. If you do not agree with the above rules, please do not post articles.

More