“Personal consumption is slowing by round 5% factors attributable to rising costs.”

(Seoul = Yonhap Infomax) Reporter Eunbyeol Yoon = The Financial institution of Korea analyzed that the rising price of client value enhance over the previous 4 years has reached about 13%, greater than twice the typical within the 2010s.

It has been estimated that the extent of the slowdown in non-public consumption attributable to such excessive costs is round 5 proportion factors (p).

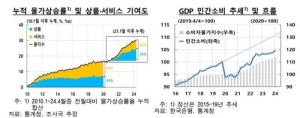

Based on the ‘Key Points in Financial Outlook for Could 2024’ report launched by the Financial institution of Korea on the twenty seventh, the cumulative price of enhance in client costs since 2021 totals 12.8%, with an annual price of three.8%, greater than twice. the typical within the 2010s (annual price of 1.4%) was excessive.

Accordingly, non-public consumption appeared to have slowed down. Evaluation reveals that consumption is displaying indicators of restoration this 12 months, however continues to be considerably under pattern.

Financial institution of Korea

Based on the report, the affect of rising costs on consumption seems in two paths: ▲ a path that reduces the actual buying energy of households, and ▲ a path that reduces the actual worth of property and liabilities.

Accordingly, it was analyzed that the affect of excessive costs varies relying on the composition of family main consumption objects (consumption basket) and monetary property.

Amongst earnings teams, the low earnings group, and amongst age teams, the aged and younger folks have been hit arduous by excessive costs.

The costs of households that eat extra objects with excessive inflation charges are extra affected. The efficient inflation charges of low-income and aged households, which eat a excessive proportion of important items similar to meals, have been larger than these of different courses at 15.5% and 16%, respectively.

Nevertheless, it was analyzed for these courses, that the affect of excessive costs was partially mitigated as a result of enhance in public switch earnings similar to nationwide pension and fundamental pension.

As well as, it was discovered that the decline in actual asset values vastly impacts the aged group, who maintain giant quantities of monetary property similar to deposits, and the younger era, who’ve a big proportion of property for rental deposits. attributable to rising costs.

Financial institution of Korea

Alternatively, the rise in rates of interest additionally had the impact of offsetting the impact of rising costs.

The aged have been the category that suffered the key damaging affect of rising costs, however benefited from rising rates of interest.

Conversely, youthful proprietor occupiers holding numerous mortgage loans benefited from the autumn in debt worth attributable to rising costs, however the impact was largely offset by larger curiosity prices attributable to rising rates of interest.

Financial institution of Korea

This report additionally included the outcomes of a quantitative evaluation of the affect of the slowdown in non-public consumption attributable to rising costs.

They discovered that the rise in costs diminished the expansion price of consumption by round 4percentp between 2021 and 2022 by a discount in actual buying energy. This can be a cumulative determine calculated between 2021 and 2022 in comparison with the fourth quarter of 2020.

Adjustments in the actual worth of property and liabilities, the second path to inflation, additionally appeared to additional cut back consumption by round 1percentc.

This evaluation is the results of inspecting solely the affect of consumption attributable to rising costs, excluding the affect of financial and monetary insurance policies.

A Financial institution of Korea official stated, “Finally, consumption elevated by about 9% between 2021 and 2022, and if not for prime inflation, consumption would have elevated by greater than 10% or double digits.”

The report concluded that as value will increase decelerate sooner or later, the affect of shrinking family consumption will weaken, however it is very important preserve value stability.

The Financial institution of Korea stated, “Excessive costs not solely weaken the actual buying energy of households typically, but in addition have a damaging redistribution impact that will increase the financial difficulties of susceptible teams, so it is very important preserve value stability.”

ebyun@yna.co.kr

(finish)

This text was revealed on the Infomax monetary info terminal at 12:00, 2 hours earlier.

Submit an SNS article

Submit an article to Fb

Ship an article to Twitter

Submit an article to Kakao Story

Ship an article by way of KakaoTalk

Submit an article to Naver Band

Submit an article to Naver Weblog

Submit an article to Pinterest

Discover different shares

#Inflation #price #years #double #earlier #common.. #Financial institution #Korea #consumption #slowdown #clear