※<청약할까말까>utilizes big data on public offering stocks recently listed by public offering stock platforms Ilyukgong and Market Insight to analyze institutional competition rates, confirmation rates, and competition rates above the upper public offering price, and provides an investment attractiveness index to investors on the day of subscription.

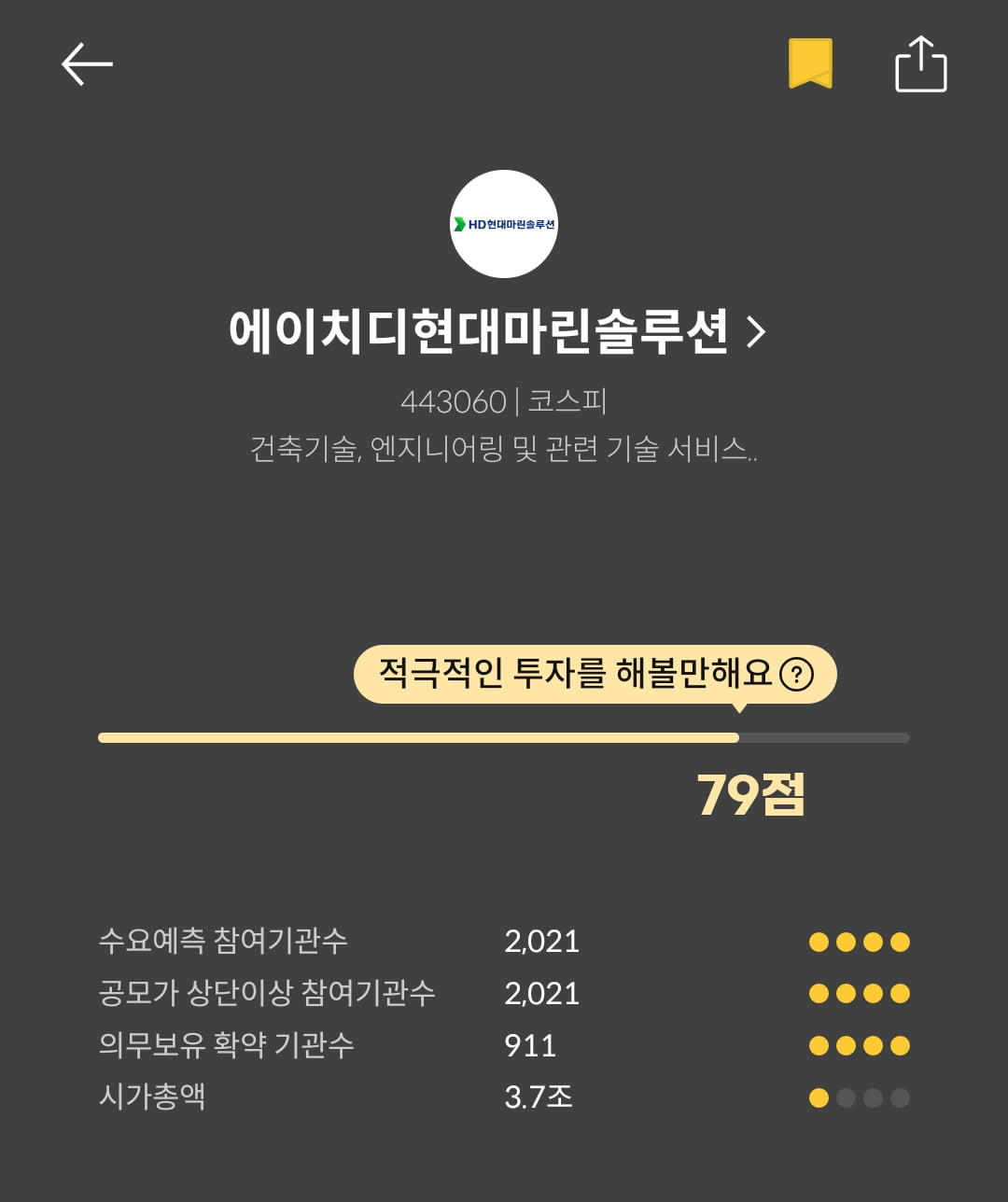

HD Hyundai Marine Solutions, which is considered the largest company in the first half of this year, will begin a general public offering for listing on the stock market on the 25th and 26th. Ilyukgong, a public stock investment platform, rated the subscription attractiveness index at 79 points. It is evaluated as a stock worthy of active investment. The profit probability was expected to be 100% and the average profit was expected to be 113%.

HD Hyundai Marine Solutions confirmed the public offering price at 83,400 won, at the upper end of the desired price range (73,400 to 83,400 won), in the demand forecast conducted earlier. The demand forecast competition rate was 201 to 1. 2021 domestic and foreign organizations participated, and all participating organizations posted a public offering price above the top.

The number of mandatory holding institutions that promise not to sell stocks for a certain period of time and apply for public stocks was 911 (46%). The amount raised through this listing is 742.3 billion won, and the market capitalization after listing is 3.7 trillion won. The volume available for distribution after listing is 16%.

HD Hyundai Marine Solutions plans to use the funds from this public offering for mid- to long-term growth, including strengthening its global network and research and development. It is scheduled to be listed on the stock market on the 8th of next month. The lead underwriters for the listing are KB Securities, UBS, and JP Morgan, and the joint underwriters are Shinhan Investment & Securities and Hana Securities. The acquisition team also included Samsung Securities and Daishin Securities.

Reporter Bae Jeong-cheol bjc@hankyung.com