Texas – As the NFL prepares for its championship game, expected to draw over 100 million viewers, the burgeoning sports betting industry is poised for a significant surge in activity. However, in states like Texas, where gambling remains illegal, residents are navigating a complex landscape of legal loopholes and offshore platforms to participate.

Texas is one of eleven states that currently prohibit both gambling and sports betting. Despite this, a substantial number of Texans are still placing wagers, fueled by advocacy efforts pushing for legalization. Jay Greer, a sports bettor from North Texas and a New England Patriots fan, exemplifies this trend. He began sports betting during the COVID-19 pandemic and has continued due to his success. “I was successful in it, so I just kept doing it,” Greer stated, adding that he is closely monitoring the odds for the upcoming championship game and believes the Patriots will win.

Industry leaders anticipate a substantial financial impact from the Super Bowl. Joe Maloney, President of the Sports Betting Alliance, estimates that $1.71 billion

will be legally wagered across the 39 states and the District of Columbia that have some form of legal sports wagering. This figure underscores the economic potential that states like Texas are currently foregoing.

The push for legalization in Texas has garnered support from major professional sports franchises, including the Dallas Cowboys, San Antonio Spurs and Austin FC. However, the effort faces significant opposition from state leaders, notably Lieutenant Governor Dan Patrick. Proponents of legalization argue that it would generate substantial tax revenue – the Sports Betting Alliance estimates over $360 million

annually – and enhance consumer protection through increased oversight.

Maloney highlighted the security benefits of legal sports betting, stating, “And to do so legally, you have to verify your age and identity, you have to give four digits of a social security number or a driver’s license number.”

This contrasts with the risks associated with unregulated platforms.

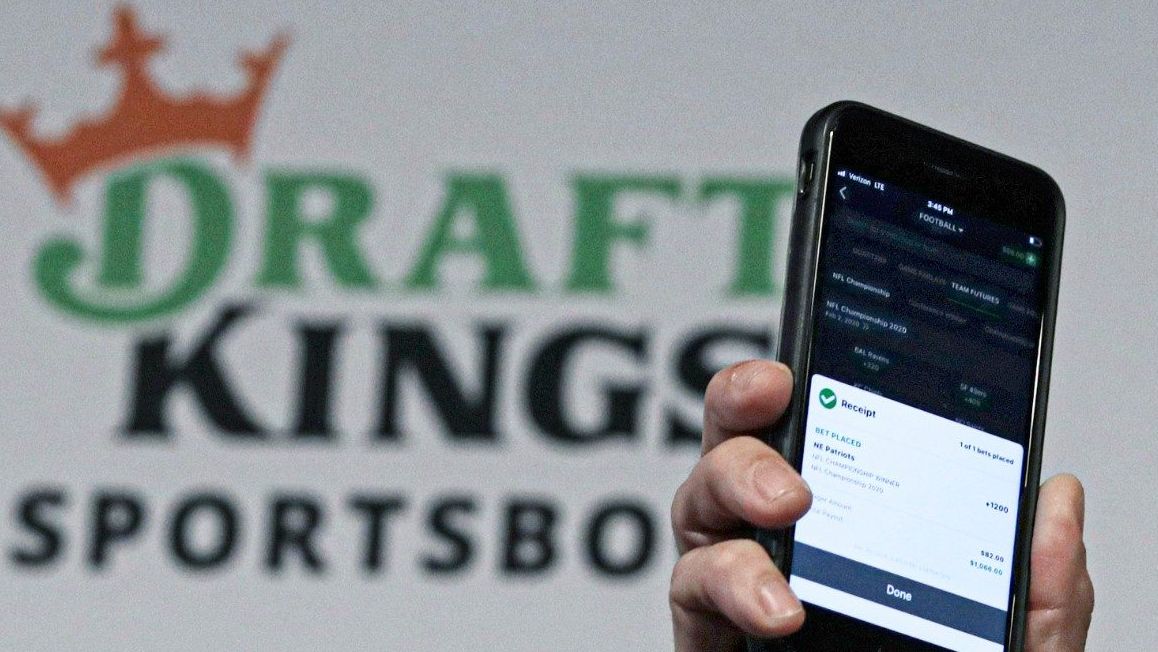

Texans seeking to place bets are currently utilizing various alternatives. Offshore betting websites and prediction market platforms like Kalshi and Polymarket operate outside of state regulations. Some bettors are leveraging legal apps such as DraftKings and PrizePicks, which have identified loopholes in states with restrictive gambling laws. Greer acknowledges the inherent risks, stating, “I get the upside of it, because I’ve been on the upside of it, but I also get the downside.”

The current situation in Texas reflects a broader national trend. While some states are embracing the economic benefits of legalized sports betting – spurred in part by the legalization of sports betting in California and Texas, as noted in a recent report – others remain hesitant. The debate centers on balancing potential revenue gains with concerns about problem gambling and regulatory challenges.

The financial services sector is experiencing a period of intense activity, as evidenced by recent deals. According to Hamilton Lane’s weekly research briefing, electronic Arts is set to be the largest buyout deal ever at $55 billion

. Medline, the largest buyout in 2021, is planning an IPO in October potentially valued at $50 billion

, which would make it the largest IPO of 2025. Verisure Plc is preparing for a public offering next week, anticipated to be one of Europe’s largest IPOs in years, with a valuation of €13-14 billion. This surge in activity is driven by significant investment commitments in artificial intelligence, potentially leading to a thirteen-digit market cap IPO.

Investment bankers and lawyers are reportedly working exceptionally long hours, and deal flow has increased substantially for general partners. Credit spreads are at all-time lows, and positive market sentiment is pushing equity market targets higher, creating a favorable environment for capital markets activity. Hamilton Lane notes that the current market environment is not one where companies can afford to be complacent, referencing John Madden’s quote: “If you can’t run with the big dogs, stay on the porch.”

The next legislative session in Texas, scheduled for 2027, will provide the next opportunity for lawmakers to address the issue of sports betting. The outcome will likely depend on the evolving political landscape and the continued pressure from industry stakeholders and sports franchises. The potential for significant tax revenue and increased consumer protection will likely remain central arguments in the debate. The success or failure of legalization efforts in Texas will undoubtedly be closely watched by other states grappling with similar decisions.

Meanwhile, the broader capital markets continue to demonstrate strength. As of the end of Q3 2025, the S&P 500 was up approximately 15% year-to-date. Wall Street strategists are revising their targets upwards, citing expectations of Federal Reserve rate cuts, historically low credit spreads, and increased corporate earnings driven by AI spending. This positive momentum presents challenges for those predicting a market downturn, particularly given the strong performance of the US consumer and the willingness of corporate activists and buyout shops to pursue underperforming companies.

Despite the generally optimistic outlook, potential disruptions remain. A US government shutdown is anticipated on Wednesday, although it is expected to have a limited impact due to the continued operation of 40% of government employees on a furlough basis. However, visits to US National Parks will be affected.