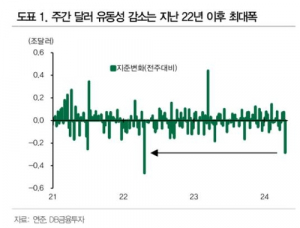

Biggest weekly drop in dollar liquidity since 2022 due to tax payments

When the exchange rate rises, 1,410 won is the short-term upper limit.

(Seoul = Yonhap Infomax) Reporter Jeong Seon-mi = An analysis has been made that the recent surge in the dollar-earned exchange rate and instability in the financial market is due to the payment of US income tax for April.

In a report published on the 22nd, DB Financial Investment researcher Hong-cheol Moon explained, “Tax payments have led to the biggest drop in weekly dollar liquidity since 2022, and the impact has been exacerbated by the combination of tightening quantitative and high interest rates. .”

Tax payment in the US starts on the 12th and ends on the 25th.

Researcher Moon said, “The amount of reduction in reserves due to income tax payments is similar to 2022, which caused the biggest change in the past,” and added, “If the final results are confirmed this week, liquidity similar to or more than 2022 will be expected from the Federal Reserve. “), he analyzed.

It was assumed that this was due to an increase in taxable income due to the expansion of nominal gross domestic product (GDP) and the sharp rise in stock prices last year.

Researcher Moon then predicted that financial instability would end after 25 days, when tax payments are due.

He predicted, “The exchange rate will be low in the short term due to tax payments being completed on the 25th and strong verbal and actual intervention by Korean foreign exchange authorities.”

The short-term upper limit was suggested as 1,410 wins, which could become an intervention level if the exchange rate rises further due to the tax effect.

The researcher Moon added, “Nevertheless, the dollar shortage may be structural depending on the Treasury’s acquisition plan, and we must prepare for the risk that the tightening of the Federal Reserve will be extended due to the characteristics of the United States, where there is a tightening effect. interest rates are delayed.”

The US Treasury’s second quarter repayment plan will be published in late April to early May.

Regarding the March personal consumption expenditure (PCE) prices in the United States published this week, Researcher Moon said, “Compared to the Consumer Price Index (CPI), it will provide a sense of stability because of the difference in the way housing costs and vehicle insurance premiums are reflected,” but he added, “There is a re-acceleration theme at work.” “As long as the Fed continues to maintain high interest rates, concerns will remain for now,” he predicted.

smjeong@yna.co.kr

(end)

This article was published on the Infomax financial information terminal at 08:50, two hours earlier.

Send an article to SNS Send an article to Facebook Send an article to Twitter Send an article to Kakao Story Send an article to Kakao Chat Send an article to Naver Band Send an article to Naver Blog Send an article to Pinterest Find other shares

#Investment #surge #exchange #rate #income #tax #payment.. #days