Domestic securities firms, foreign real estate funds likely to suffer additional losses… Unrecognized loss of 3.6 trillion

(Seoul = Yonhap Infomax) Reporter Song Ha-rin = It was noted that among the foreign real estate funds invested by domestic securities companies, losses worth 3.6 trillion won have never been recognized, suggesting the possibility of additional losses in the future.

On the 15th, Nice Credit Rating said in its ‘Investigation into Foreign Real Estate Exposure and Related Losses of Securities Companies’ report, “Potential insolvency has started to become a reality, and there is a possibility that additional insolvency will occur.”

The total foreign real estate exposure of the 25 securities companies whose credit ratings Na Shinpyeong evaluates is 14.4 trillion won. In most cases, it is structured to collect cash flow generated from completed real estate, such as rental income.

By type of investment, real estate funds and REITs/equity investments account for the largest amount at KRW 8.7 trillion.

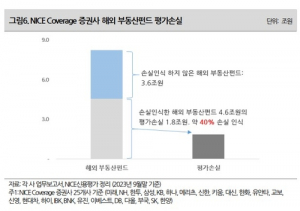

For the 8.3 trillion won in foreign real estate funds, 25 securities companies recognized a valuation loss of about 1.8 trillion won (22%) at the end of September last year. Among these, 4.6 trillion won showed a high valuation loss rate of about 40%.

However, no losses have yet been recognized for foreign real estate funds worth about 3.6 trillion won.

By maturity, funds maturing between 2023 and 2026 showed a valuation loss rate of around 26% at the end of September last year, and additional losses related to foreign real estate were recognized in the fourth quarter of last year.

Na Shinpyeong said, “The decrease in rent demand and the continuation of the high interest rate trend act as negative factors on the overseas real estate market,” and expressed concern that “there is always the possibility of additional losses due to domestic securities companies. ‘ exposure to foreign real estate.”

From a securities company, at the end of September last year, six companies with foreign real estate exposure more than 1 trillion won: Mirae, NH, Hana, Meritz, Shinhan, and Daishin Securities. They have a quantitative burden as their exposure to foreign real estate is around 31% compared to their equity capital.

Exposure to foreign real estate led to a decline in the performance of securities firms.

The combined interim performance of Mirae, Meritz, and Shinhan Investment & Securities last year fell 58%, 29%, and 76%, respectively, compared to the previous year. Hana Securities turned out to be a loss.

Na Shinpyeong said, “There was a significant decline in performance compared to the previous year, focusing on Mirae, Hana, Meritz, and Shinhan,” and “Given that the scale of overseas real estate-related losses last year was significant, large-scale loss recognition was implemented for foreign real estate exposure.” “This appears to be the main reason for the decline in the performance of the relevant securities companies last year.”

However, in the case of securities companies linked to financial holding companies, it was decided that there was room and possibility for support, such as a capital increase paid in by the parent company and the acquisition of subordinated bonds.

Shinhan Financial Group announced 400 billion won last month, and BNK Financial Group announced 200 billion won this month. KB, Meritz, and Hana Financial Group plan to issue new types of capital securities worth 270 billion won, 150 billion won, and 270 billion won, respectively, this month.

Na Shinpyeong said, “Compared to the 4 to 5 financial holding companies that issued sub-bonds in January and February at the beginning of the year, a total of 6 companies have issued or plan to issue new types of securities capital this year,” adding, “Additional large-scale losses are expected in the future.” “We intend to reflect the event and the amount of financial support from the financial holding company in the credit rating if necessary,” he said.

hrsong@yna.co.kr

(end)

This article was published at 13:57 on the Infomax financial information terminal.

Send an article to SNS Send an article to Facebook Send an article to Twitter Send an article to Kakao Story Send an article to Kakao Chat Send an article to Naver Band Send an article to Naver Blog Send an article to Pinterest Find other shares

#foreign #real #estate #exposure #securities #companies #including #Mirae #Hana #Meritz #Shinhan #exceeds #KRW #trillion