The stock market never guarantees 100% returns. Therefore, beginners who are unfamiliar with stock investing are likely to invest in stocks they know. In this respect, stocks of well-known large companies are considered one of the stocks preferred by investors with a stable disposition. However, in a situation where there is a long-term economic downturn and the internal and external environment has worsened, it is difficult for even large corporations’ stocks to maintain their stock returns through brand alone. In the case of companies with poor operating performance or no new growth engines, the stock price return curve was downward. On the other hand, group stocks that presented good operating performance and new business momentum this year saw their stock prices trend upward. Accordingly, this paper will look at the stock price returns of the top 10 conglomerates in the business world and find out the causes and prospects. <편집자주>

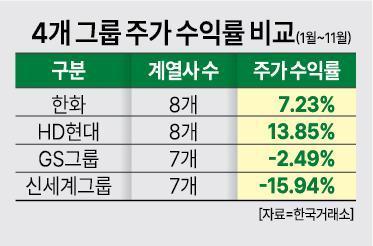

Hanwha, GS, HD Hyundai, and Shinsegae had different stock price returns depending on the performance of each business. These companies rank from 7th to 11th in the business rankings, with total assets ranging from 60 trillion won to 100 trillion won. Shinsegae is virtually considered a top 10 group, excluding its union, Nonghyup (KRW 71.4 trillion).

According to the Korea Exchange on the 27th, there are eight listed companies in the Hanwha Group, and the average stock price return of these listed companies (as of the 24th) was 7.23%. In the case of Hanwha, major affiliates are showing signs of excellence by improving operating performance and forming new business momentum.

Looking at the stock price returns of these affiliates, △Hanwha Life Insurance 6.80% △Hanwha Non-life Insurance -12.00% △Hanwha Solutions -36.80% △Hanwha Aerospace 63.20% △Hanwha Investment & Securities 21.90% △Hanwha Systems 51.20% △Hanwha Galleria -48.30% △Hanwha REITs 11.80%, etc.

Currently, the business that Hanwha Vice Chairman Kim Dong-kwan is focusing on is the space and defense industry. Accordingly, Hanwha Aerospace is showing the highest rate of return among affiliates.

As the secondary battery and solar energy industries have recently recovered rapidly, especially in the U.S. and Europe, performance improvement of related affiliates is also expected.

Hanwha Momentum, which manufactures equipment necessary for battery production within the Hanwha Group, recorded sales of KRW 144.7 billion in the third quarter of this year due to expansion of the U.S. solar module line and expansion of domestic secondary battery kiln (heat treatment-related equipment). This is a 23% increase compared to the same period last year.

In addition, the sluggish stock price return of Hanwha Solutions, which was considered a key affiliate in the solar energy business, is expected to rebound.

Lee Jin-myeong, a researcher at Shinhan Investment & Securities, explained, “We have high expectations for the establishment of a U.S. solar power value chain with solid demand and price premiums,” and added, “As a company specializing in new and renewable energy, Hanwha Solutions’ competitiveness will increase, making it possible to reevaluate its stock price.” .

Eight of HD Hyundai’s listed affiliates benefiting from the robot business were found to be recording a good stock price return of 13.85% on average.

The average stock price return of HD Hyundai Group listed companies is △HD Korea Shipbuilding & Marine Engineering 43.70% △HD Hyundai 8.00% △HD Hyundai Heavy Industries 2.00% △Hyundai Mipo Dockyard -2.30% △HD Hyundai Electric 114.60% △HD Hyundai Construction Equipment -12.30% △HD Hyundai Infracore 6.30% △HD Hyundai Energy Solution -49.20%, etc.

The stock market is giving positive evaluations to HD Hyundai. Recently, HD Hyundai Construction Equipment and HD Hyundai Infracore won new orders from Saudi Arabia, and expectations for reconstruction following the Morocco earthquake and the Russia-Ukraine war were also formed. In addition, unlisted companies such as HD Hyundai Robotics and HD Hyundai Global Services are also expected to re-evaluate their corporate values.

Han Young-soo, a researcher at Samsung Securities, explained in the HD Hyundai corporate report, “The listing of robot companies affiliated with large domestic companies and the strengthening of shipping regulations have created conditions for the value of unlisted subsidiaries to be reevaluated.”

In particular, the pace of the robot business is expected to accelerate. On the 10th, HD Hyundai Group carried out personnel changes to its president team, including the promotion of CEO Jeong Ki-seon to vice president. Vice Chairman Chung plans to serve as a keynote speaker at CES2024 to be held early next year and introduce cutting-edge future technologies such as robots, digital conversion, eco-friendly ships, and hydrogen.

On the other hand, the stock price returns of listed companies affiliated with GS Group and Shinsegae Group were sluggish.

First of all, GS Group’s seven affiliated listed companies recorded a stock price return of -2.49% since the beginning of the year. Looking at the stock price returns of these affiliates, they are △GS 0.80% △GS Retail -9.90% △GS Global 16.70% △GS Engineering & Construction -16.90% △XS&D -11.70% △Samyang Trading -10.60% △Hugel 14.20%.

In the case of GS E&C, which recorded the poorest stock price return among listed affiliates, investment sentiment is interpreted to have been greatly depressed after the decision to completely rebuild the company due to the collapse of the underground parking lot of the Geomdan Apartment in Incheon.

Lee Min-jae, a researcher at NH Investment & Securities, said, “Due to the Incheon Geomdan collapse, doubts about the domestic housing business are bound to increase,” and added, “The real estate economy will remain in a difficult situation in the second half of the year due to a decrease in the number of pre-sale units, an increase in unsold units, and a reversal of trends.” did.

Shinsegae also has sluggish stock returns. This can be interpreted as the impact of the sluggish third quarter operating performance of major affiliates due to a slowdown in consumption.

The 7 listed companies of Shinsegae Group are △Shinsegae -20.60% △E-Mart -17.80% △Gwangju Shinsegae -5.00% △Shinsegae Construction -15.80% △Shinsegae I&C -7.80% △Shinsegae Food -13.70% △Shinsegae International -30.90%, etc. on average compared to the beginning of the year. It recorded a stock return of -15.94%.

Shinsegae International, which recorded the poorest stock price return among Shinsegae Group affiliates, recorded sales of 315.8 billion won and operating profit of 6 billion won in the third quarter of this year. In the case of overseas fashion, sales and operating profit decreased by 34% and 71%, respectively, as major brand contracts ended. The domestic fashion division also saw a 28% decrease in sales and recorded an operating loss of 2.3 billion won.

Seo Hyeon-jeong, a researcher at Hana Securities, said, “The slowdown in performance is greater than expected due to a decline in consumption, a downcycle in the consumption of durable goods such as clothing, and the end of contracts with major overseas brands,” and added, “In the case of the clothing business, which is classified as an economically sensitive industry, discount competition and inventory will occur in the future.” “As the burden increases, there is a risk of further performance decline,” he said.

Reporter information Seungwoo Hong hongscoop@ajunews.com

©’Global economic newspaper in 5 languages’ Aju Economic Daily. Reproduction and redistribution prohibited.