It was a day I had been waiting for a long time. I woke up much earlier than the time I set my alarm and opened my phone to check if a text message had arrived. Unfortunately, the text I was waiting for did not arrive, and I think I checked my phone frequently that morning.

A little after 11 a.m., I finally received the text I had been waiting for. [청년저축계좌 해지완료] As soon as I received the text message, about 11 million won in government subsidies and about 3.7 million won in my own payment were deposited into my bank account. It was the end of the long-awaited youth savings account.

This is the text I’ve been waiting for for a long time. As soon as the youth savings account cancellation completion text message was received, both the government support fund and the individual’s own payment were deposited.

The Youth Savings Account is a policy that was the predecessor of the Youth Tomorrow Savings Account, which can be said to be the representative of the current youth asset formation support project. At that time, a certain number of low-income young people were selected through screening, and the selected people contributed 100,000 won in savings for 3 years (36 months). Of course, there were many difficult tasks aside from maintaining savings consistently for three years.

Because I did not have much financial freedom, I was worried about whether I should cancel my savings account or apply for payment suspension before moving and paying my family’s hospital bills, which required a large sum of money. Since maintaining employment was a condition, I continued to work even when I was not feeling well. I had to work.

A lot of preparation was needed to complete a certain number of hours of education and prove usage history, which were the expiration conditions for the youth savings account, but above all, I put in a lot of effort to achieve ‘obtaining at least one nationally recognized qualification’, which was one of the essential conditions. The reason I was able to endure despite various difficulties was because I was able to dream of maturity with the government subsidy of 300,000 won matched every month.

Maturity funds from the youth savings account were used to repay loans, etc. (Source = Naver Pay credit information)

The joy of seeing a large amount of money in my bank account for the first time in a long time was short-lived, but my bank account balance soon returned to the average level due to loan repayment. However, the leisure I gained and the motivation for the future through the maturity of my youth savings account were greater than the maturity amount. In fact, my acquaintances who signed up for a youth savings account during the same period as me also gave rave reviews about the savings account.

An acquaintance who participated in the first class in 2021 said that he used half of the maturity amount to repay his student loans, and that he plans to use some of the remaining half to move to a better place and another half to go on an overseas trip that he has dreamed of for a long time. . An acquaintance said, “It is the best policy that helped low-income young people dream of their future.”

Another friend who completed the maturity cancellation a week earlier than me said that most of the maturity amount would be used to prepare for a wedding next year. My friend said, “This policy has been a great help to me, so if you are eligible for the asset formation policy, I hope you can apply without hesitation and be able to create your own future.”

Recruitment for Youth Tomorrow Savings Account and Hope Savings Account Type 2 will begin on May 1. The expected schedule for each policy can be checked through the table. (Source = Asset e-roomter homepage)

As my friend said earlier, there is a youth asset formation support project that you should not miss and apply for if you are a beneficiary of the policy. The asset formation support project, which will be recruiting from May 1, is the Hope Savings Account Type 2 and the Youth Tomorrow Savings Account. The Hope Savings Account Type 1, targeting recipients of living medical benefits, will open in June (scheduled for June 3 to 14). A third round of recruitment is scheduled.

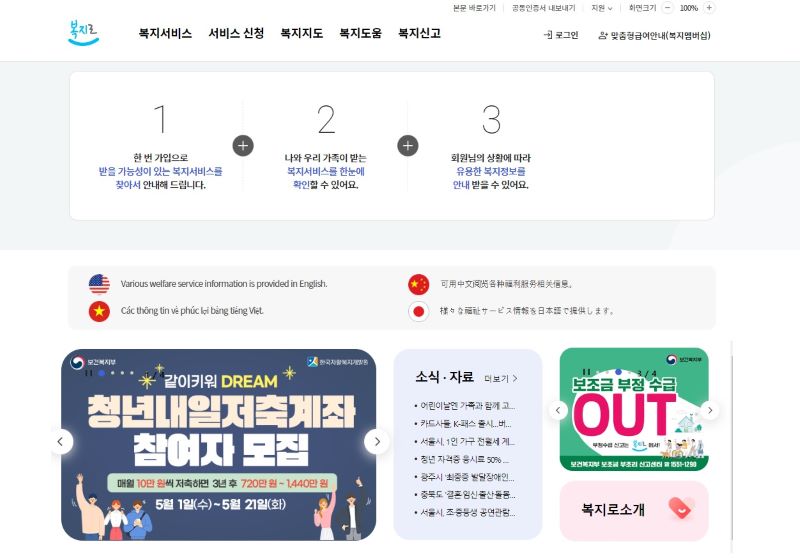

First of all, the Youth Tomorrow Savings Account, which is a successor to the Youth Savings Account I signed up for, will be recruiting from May 1st to 21st. Applications can be made through nearby administrative welfare centers and online welfare channels, and final membership will be decided in August after eligibility review.

I was able to find more detailed information related to the Youth Tomorrow Savings Account. Information on other youth asset formation projects can be found on the Bokbok-ro and Jasan e-Roomte websites. (Source = Jasan e-Roomteo)

The Youth Tomorrow Savings Account has expanded its membership significantly and is divided into those below the next lowest class and those above the next lowest class, and you can join if you earn less than 2.2 million won per month in earned income or from business. Depending on the age, those in the next lower class can sign up between 15 and 39 years old, and those above the next lower class can join between 19 and 34 years old.

In the case of the government matching subsidy, those in the next lowest bracket can receive a maturity payment of 14.4 million won excluding interest at maturity by saving 100,000 won per month through 1:3 matching, and for those exceeding the next highest class, approximately 7.2 million won at maturity through 1:1 matching. You can receive the maturity amount of won.

In the case of Type 2 Hope Savings Account, households receiving housing and education benefits and other low-income households whose recognized income is less than 50% of the standard median income can participate. They must be currently working and generating income from work or business. .

The recruitment schedule for Type 2 will be from May 1st to 20th, and after screening, those eligible to join will be confirmed in July. If you are selected for this type, you will receive a 1:1 matching payment when you save 100,000 won per month and receive a maturity payment of 7.2 million won at maturity. If you are a low-income young person who has never participated in an asset formation support project, you can consider the Youth Tomorrow Savings Account first. If that is not possible, you can consider the Hope Savings Account Type 2 as the next best option.

You can apply for both the Youth Tomorrow Savings Account and the Hope Savings Account through nearby community centers and welfare centers. The main screen of Bokro was also promoting the Youth Tomorrow Savings Account scheduled to open on May 1. (Source = Bokkro)

The youth asset formation support project can clearly be said to be a policy that will provide a significant boost to the future of young people. If you are eligible to apply for the policy, don’t worry and apply during this recruitment period. We support the youth asset formation support project that will provide wings to young people who need help for their future.

Republic of Korea Policy Reporter Lee Jeong-hyuk jhlee4345@naver.com