COCOCO Shares Soar in First Trading Day, Company’s Business Overview

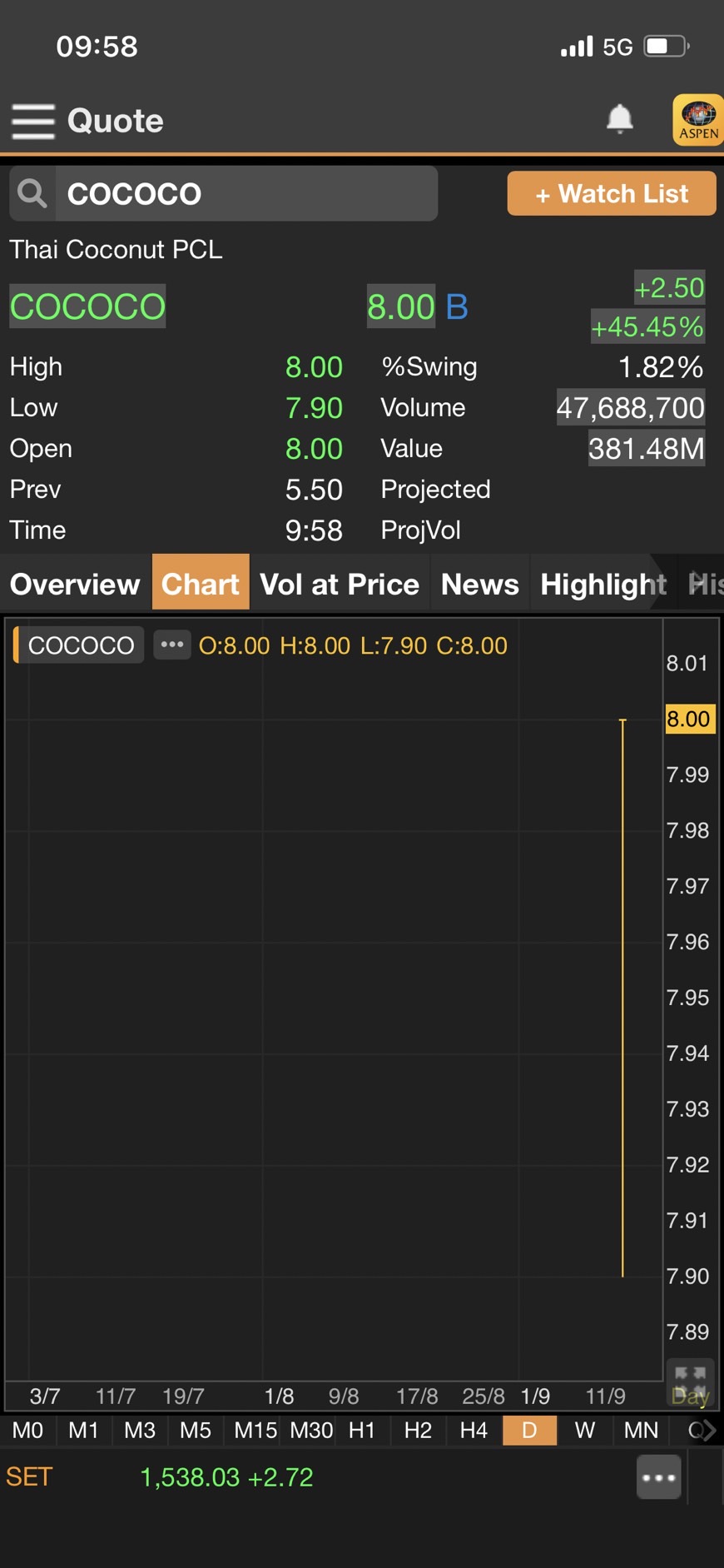

In a remarkable debut, shares of Thai Coconut Public Company Limited (COCOCO) surged on its first trading day, opening at 8.00 baht. This marked a significant increase of 2.50 baht or 45.45% from its initial public offering (IPO) price of 5.50 baht.

Globelex Securities, in its comprehensive analysis, shed light on COCOCO’s diverse product offerings. The company primarily specializes in the production and sale of processed products derived from coconuts and aromatic fruits. These products are marketed under two flagship brands, Thaicoco and Cocoburi, contributing to a significant proportion of the company’s overall revenue, amounting to 88%. Additionally, COCOCO manufactures and distributes healthy wet pet food for dogs and cats, known as the Moochie brand, accounting for 7% of total revenue. The company has also expanded its business to include the production and sale of plant-based protein foods, including cheese and butter alternatives, which contribute 3.5% of total revenue. COCOCO primarily operates through original equipment manufacturing (OEM) agreements, which constitute 91% of its revenue, while the remaining 8% is generated through sales under the company’s own brand. The company’s export revenue amounts to a significant 88%, with a strong presence in Asia, comprising 52% of total exports, followed by America at 23% and Europe at 20%.

Despite facing challenges related to insufficient shipping capacity for exports, COCOCO managed to achieve a total income of 3,381 million baht in 2022, experiencing a slight decline of 3% from the previous year. However, the company’s net profit soared to 302 million baht, indicating a remarkable 25% year-on-year growth. This was primarily attributed to lower coconut prices and efficient cost management, resulting in a net profit margin of 8.9% in 2022, showing an impressive improvement of 6.95% compared to the previous year. Furthermore, in the first six months of 2023, COCOCO witnessed a substantial increase in total income, reaching 1,992 million baht, marking a notable 17% year-on-year growth. The company’s net profit also experienced a significant surge, amounting to 198 million baht, showcasing an impressive 57% year-on-year growth. The net profit margin for this period stood at a commendable 9.9%, driven by the expansion of the coconut water product market in China and America. It is worth noting that coconut water products offer better profit margins than coconut milk products.

The IPO price for COCOCO shares was strategically calculated to reflect a price-to-earnings (P/E) ratio of 22 times, which closely aligns with the average P/E ratio of stocks in the same industry, standing at 22.8 times. The company issued 370 million shares during the IPO, successfully raising 2,035 million baht in funds. Additionally, the value of warrants at the IPO price amounted to an impressive 8,085 million baht. COCOCO intends to allocate these funds for various purposes, including expanding the production capacity of coconut products and enhancing warehouse infrastructure. Furthermore, the company aims to invest in machinery and equipment to diversify its product line of dog and cat snacks. COCOCO also plans to expand its ice cream production capabilities, repay existing loans, and utilize the remaining funds as working capital.

Bloomberg Consensus Estimates COCOCO Share Price Range

According to Bloomberg Consensus, COCOCO shares are expected to trade within a range of 10.80 to 14.40 baht.

COCOCO opened its first trading day at 8.00 baht, up 2.50 baht or 45.45% from the IPO price of 5.50 baht.

Globelex Securities said in its analysis that Thai Coconut Public Company Limited (COCOCO) produces and sells processed products from coconuts and aromatic fruits. under the Thaicoco and Cocoburi brands (88% of total revenue), produces healthy wet pet food for dogs and cats under the Moochie brand (7% of total revenue), and produces and sells healthy protein food plants, including cheese and butter products made from plants (3.5% of total revenue), contract manufacturing (OEM) accounting for 91% and sales under the company’s own brand accounting for 8%. Revenue from exports accounts for 88%, with the main market in Asia 52%, followed by America 23% and Europe 20%.

In 2022, total income was 3,381 million baht -3% YoY due to the problem of insufficient shipping capacity for exports. But net profit of 302 million baht +25%YoY, net profit margin of 8.9%, improved by 6.95% in 2021 from lower coconut prices and good cost management.In the 6M23 period, total income was 1,992 million baht +17%YoY and a net profit of 198 million baht +57%YoY, a net profit margin of 9.9% from the expansion of the coconut water product market to China and America. And coconut water products have better margins than coconut milk products.

The IPO price is calculated as a P/E ratio of 22 times, close to the average of stocks in the group of 22.8 times. The number of IPO shares is 370 million shares. The value of the money raised is 2,035 million baht. The value of warrants at the IPO price is 8,085 million baht Raising funds for 1. Expanding the production capacity of Coconut products and expanding the warehouse 2. Purchase of machinery and equipment to expand the product line of dog and cat snacks 3. Purchase of machinery and equipment to expand ice cream production 4. Repay loans and 5. Use as working capital.

Bloomberg Consensus 10.80-14.40 baht

#HILITE #COCOCO #opens #trading #day #baht #order

/cloudfront-ap-northeast-1.images.arcpublishing.com/chosun/MR3HDH3ESISIIFYWRQUI2XSLWE.jpg?fit=300%2C300&ssl=1)