Major domestic security companies have made a full effort to target the Japanese security market. This is interpreted as an attempt to diversify the sales and profit structure by entering the Japanese market, which has high growth potential.

According to the industry on the 26th, domestic companies such as AhnLab, PIOLINK, Igloo Corporation, Soft Camp, and Sparrow participated in the information technology (IT) exhibition ‘Japan IT Week Spring’ held in Tokyo, Japan for three days from’ r 24th. and started targeting local customers.

‘2024 Japan IT Week Spring’ is Japan’s largest IT fair where companies in various IT fields, from hardware (HW) to software (SW), participate, and as of last year, more than 45,000 people attended.

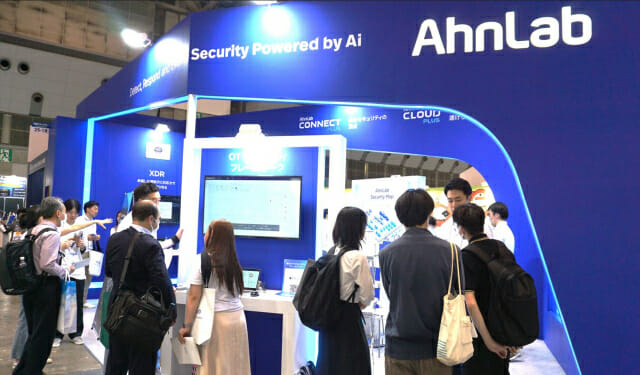

AhnLab participated in ‘Japan IT Week Spring 2024’, which was held for three days starting on the 24th. (Photo = AhnLab)

Domestic security companies presented next-generation security technologies such as trustless, cloud, and artificial intelligence (AI) through a joint Korean pavilion led by the Korea Information Security Industry Association (KISIA). Seven companies, including Gaon Broadband, Stillian, Igloo Corporation, Injeongbo, Piolink, Penta Security, and M Clouddog, jointly operated a pavilion. AhnLab, Soft Camp, and Sparrow participated separately in this event.

AhnLab targeted local companies by offering an operational technology (OT) security solution that could be adopted by the Japanese manufacturing industry. OT security is necessary to build a secure industrial control system, and as the control of production facilities such as pumps, valves, and robot arms is digitally transformed (DX), the importance of related security has also increased.

AhnLab has the ‘AhnLab OT Framework’ solution which provides visualization of all components of the OT network and threat detection and response. Subsidiary Naonworks provides deep packet analysis (DPI) technology that can identify equipment within an industrial control system (ICS) and detect and analyze abnormal control. Ahnlab said that major Japanese manufacturing companies are showing a lot of interest this time.

AhnLab also introduced ‘V3 Security for Business’, a software-as-a-service (SaaS) security solution targeting local SMEs. This solution is characterized by the ability to manage and secure operating systems (OS) and devices without a server or system.

In addition, AhnLab received positive responses from visitors by introducing ‘AhnLab XDR’ security threat analysis platform, ‘AhnLab EPS’ special purpose security solution, and ‘AhnLab TIP’ threat information delivery platform.

PIOLINK pioneered its ‘T-Front’ product, which generated sales of 6.5 billion won in the Japanese market last year. T-Front is a network and security product that centrally manages wired and wireless network devices such as switches and access points (APs) through an ‘integrated cloud-based management system’ and also plays the role of security management. PIOLINK expands its security domain by connecting to firewalls and virtual private networks (VPNs) in Japan and managing internal and external network threats.

Soft Camp took part in the cloud section under the theme ‘Zero Trust Teleworking Security Measures’. SHIELDGate, a web isolation security service based on zero trust, was introduced as the main service.

Shield Gate faithfully complies with the security measures required by the Information Protection Guidelines when using cloud services in Japanese local government business terminals. Remote browser isolation technology helps ensure use of cloud services on the internal network. It improves usability and work productivity through an isolated web browser, while also providing the same external threat blocking effect as network isolation.

Igloo Corporation (Photo = GD Net Korea DB)

Igloo Corporation unveiled security solutions and services that focus on its unique AI and security development capabilities. We showcased ‘SpiDER SOAR’, a security action/threat response automation (SOAR) solution, and ‘AiR (AI Road)’, an AI detection model service based on classification, explanation, and creation AI technology, in collaboration with local Japanese companies . . more points of contact and strengthening relationships of trust.

Lee Deuk-chun, CEO of Igloo Corporation, said, “By participating in this Japan IT Week, we will introduce Igloo Corporation’s security and information technology to the Japanese market and lay the foundation for expanding our business in Japan. deep understanding of the Japanese IT market and our wide network, “We will strengthen the influence of Igloo Corporation in the Japanese security market,” he emphasized.

Sparrow presented security vulnerability analysis solutions such as Sparrow On Demand, Sparrow Cloud, and Sparrow Enterprise under the theme ‘Quality and Security Management Plan for Trusted Applications.’

Sparrow On Demand provides application security vulnerability analysis services such as static analysis (SAST), dynamic analysis (DAST), and software component analysis (SCA) in the form of an application programming interface (API). Sparrow Cloud supports this in the form of Software as a Service (SaaS).

Stillian introduced the AppSuit Remote Block, Reader, and AV series, starting with ‘AppSuit Premium’, an integrated app security solution that securely protects mobile applications from various cyber attacks. The product name will reportedly be changed to ‘Mobishell’ in Japan.

The reason why domestic security companies are actively targeting the Japanese market is their high growth potential. According to the Japan Network Security Association (JNSA), the size of Japan’s security market is 1.3321 trillion yen (about 11 trillion won) in 2021, and 1.4983 trillion yen (about 13 trillion won) last year, more than twice the large domestic market.

Related articles

For this reason, the share of exports of domestic companies to Japan is also the largest. According to the Korea Information Security Industry Association (KISIA) survey statistics (as of 2022), the country with the largest share of information security industry exports is Japan (44.0%). This was followed by the United States and China (13.9% each) and Europe (6.4%).

An industry official said, “Even excluding the US, which is the largest market, Japan is a representative region where you can get the right price in terms of sales and maintenance.” He added, “There is no need to bear the burden of ‘price suppression’, and the market is better than Korea.” “It’s attractive because it’s two or three times bigger.”

#country #small #Korean #security #companies #leaving #Japan #succeed #13兆 #market

/cloudfront-ap-northeast-1.images.arcpublishing.com/chosun/DNN75TEOQNEPHHQM4YPPAPUJNA.gif?fit=300%2C300&ssl=1)