According to option data analysis, the stock price may fluctuate by 10.6% after the earnings announcement.

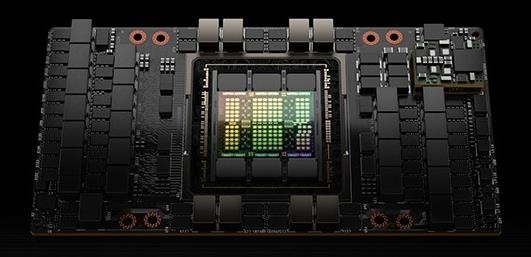

NVIDIA’s flagship AI semiconductor, H100

[엔비디아 홈페이지 캡처]

(Seoul = Yonhap News) Reporter Joo Jong-guk = Investors are showing keen interest in NVIDIA’s performance, which will be announced after the New York Stock Market (NYSE) closes on the 21st (local time).

Bloomberg News reported on the 20th that the market capitalization of $200 billion (approximately KRW 267.28 trillion) will depend on the performance of Nvidia, known as the ‘artificial intelligence (AI) leader’.

As a result of Bloomberg’s compilation of stock market option betting data on NVIDIA, it was found that NVIDIA’s stock price could move 10.6% on the 22nd, the day after the earnings announcement. Nvidia’s market capitalization could fluctuate by about $180 billion.

advertisement

Although it is less than the stock price fluctuation of the meta platform, which recorded both the largest drop and the largest rise in a day, it is clear that it will be an unprecedented rise or fall.

NVIDIA is the company that has risen the most among the Standard & Poor’s (S&P) 500 index stocks this year.

Nvidia contributed about 30% of the increase in this index this year. Therefore, if stock prices rise or fall significantly after earnings announcements, it is highly likely that major indices will also be affected.

Nvidia fell as much as 6.7% during the trading day on the 20th, a day before its earnings announcement, dragging down the large-cap index.

“Nvidia’s stock price has risen a lot recently, so some investors are scared to buy more, but others are afraid of missing out if the stock price rises further,” said Christopher Jacobson of Susquehanna International Group.

NVIDIA’s stock price has not changed significantly since the last two quarterly earnings announcements. However, after the performance announcement in February and May of last year, the stock price rose 14% and 24%, respectively.

According to option betting data compiled by Sesquehanna Group based on Nvidia’s closing price on the 16th, there was about a 25% chance that Nvidia’s stock price would move out of the range of $620 to $850. This means that the stock price will plummet by 15% or surge by 17%.

satw@yna.co.kr

Report via KakaoTalk okjebo

<저작권자(c) 연합뉴스,

Unauthorized reproduction/redistribution, AI learning and use prohibited>

2024/02/21 11:05 Sent