Dietary storage to cut back working prices

Improve the variety of department places of work for the financially weak

Specializing in asset administration concentrating on Younger & Wealthy

[이데일리 정병묵 기자] Banks are decreasing branches and growing department places of work to cut back working prices. It is a determined measure to take care of retailer numbers whereas decreasing prices whereas the monetary companies panorama shifts to cell banking. As well as, so as to enhance the profitability of offline shops, it seems to focus on wealth administration (WM) shops for top web value people.

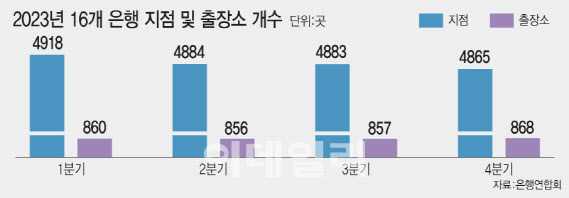

In line with the Korea Banks Federation on the twenty sixth, the variety of branches of 16 home banks on the finish of the fourth quarter of final yr was 4,865. It fell steadily from 4,918 within the first quarter of final yr to 4,884 within the second quarter and 4,883 within the third quarter. Alternatively, the variety of department places of work is growing. It elevated from 860 on the finish of the primary quarter final yr to 868 on the finish of the fourth quarter final yr.

Wanting on the particulars of the financial institution, NH Nonghyup Financial institution closed a complete of six branches in Seoul, Busan, Daegu, Daejeon, and Incheon throughout the fourth quarter of final yr. Woori Financial institution additionally closed six branches in Seoul, Incheon, and Sejong, and SC First Financial institution closed 5 branches in Seoul alone. Throughout the identical interval, Woori Financial institution opened six department places of work in Seoul, Gyeonggi, Jeonbuk, and Incheon, and Hana Financial institution additionally opened two new branches in Seoul and Gyeonggi.

The explanation why banks are decreasing branches and growing department places of work is for value effectivity. A financial institution department workplace is a sort of easy retailer that’s smaller than a standard financial institution department and offers with deposits and receipts, however doesn’t cope with particular duties corresponding to company finance. In contrast to branches with round 10 workers, the department is far smaller with lower than 5 workers.

There’s additionally loads of criticism that offline shops must be held for the financially weak. The variety of home financial institution branches is small in comparison with main international locations around the globe. In line with the Korea Institute of Finance and Financial Analysis, the variety of financial institution branches per 100,000 grownup inhabitants in Korea is 14.4 as of 2020, which is decrease than the extent of OECD international locations Other than the department ‘food regimen’, efforts are being made enhance Welsh medium facilities to catch ‘Younger & Wealthy’. Earlier this month, KB Monetary Group opened ‘KB Gold & Smart the First’, a complete asset administration middle in Banpo-dong, Seocho-gu, Seoul. It has a complete of 11 customer support facilities and roughly 850 state-of-the-art secure deposit bins. Personal bankers from KB Kookmin Financial institution and KB Securities, in addition to high consultants in monetary and non-financial fields corresponding to funding, taxation, actual property, regulation and belief, work as a staff to handle clients.

Woori Financial institution additionally introduced in March that it could recruit numerous asset administration specialists and enhance the variety of asset administration specialist branches from the present 6 to twenty by 2026. In 2022, Shinhan Financial institution established Shinhan PWM Household Workplace, a administration model property for these with property value greater than 10 billion gained, and opened Gangnam Middle, Seoul Middle, and Banpo Middle.

An official from a business financial institution stated, “We’re increasing branches to focus on areas with numerous aged people who find themselves inconvenient for cell banking,” and added, “Utilizing offline shops is transferring to asset administration, the place a face is face -face-to-face session companies are important sooner or later.”

ⓒ Complete financial data media On a regular basis – Business replica and redistribution prohibited

#Scale back #branches #enhance #facilities.. #Survive #Financial institution